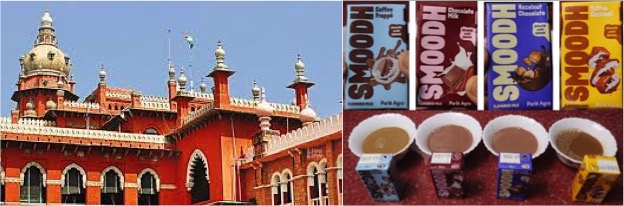

While giving relief to Parle Agro on taxability of flavoured milk, the Madras High Court has held that GST Council cannot determine the classification,

A single judge bench, in its recent ruling, held that flavoured milk would attract GST at the rate of 5 per cent. The GST Council, in its meeting on December 22, 2018, classified ‘flavoured milk’ under the HSN (Harmornised System of Nomenclature) Code 2202. Accordingly, it attracted GST at the rate of 12 per cent. Now the question was whether it is a ‘beverage containing milk’ (HS Code 2202, GST rate 12 per cent) or ‘Milk and Cream (Chapter 0402, GST rate 5 per cent).’

“GST Council has given a wrong recommendation. It also cannot determine the classification. Determination of classification also does not fall within the preserve of the respondent GST Council,” a bench of Justice C. Saravanan said. Further, the bench said Classification ought to have been independently determined by the Assessing Officer. “It is for the Government to fix an appropriate rate on goods that are classifiable under the Customs Tariff Act, 1975,” it said.

The bench quoted the Supreme Court’s ruling in the case of Mohit Minerals. The apex court had observed that the recommendations of the GST Council are not binding on the Union and states. The deletion of Article 279B and the inclusion of Article 279(1) by the Constitution Amendment Act 2016 indicates that Parliament intended for the recommendations of the GST Council to only have a persuasive value, particularly “when interpreted along with the objective of the GST regime to foster cooperative federalism and harmony between the constituent units,” the apex court said in its ruling.

Meanwhile, on the issue of flavoured milk, the single judge bench of the Madras High Court observed that this expression has to necessarily contain alcohol of specified strength and hence ‘flavoured milk’ made out of diary milk from milch cattle/ dairy animals cannot come within the purview of Chapter 22 . It applied the principle of ‘Nosciter – a sociss’ (that the words must take colour from words with which they are associated) to arrive at finding that the expression ‘Beverage Containing Milk’ can include only such beverage containing plant/ seed-based milk, which incidentally contains alcohol of specified strength, such as coconut milk, almond milk, peanut milk, lupin milk, hazelnut milk, pistachio milk, walnut milk or seed-based milk such as sesame milk and flax milk.

The bench held that notifications under the erstwhile Central Excise Act, 1944, classifying ‘Flavoured Milk’ as ‘Beverage Containing Milk’, were ‘erroneous’ and just because they were never contested by assessees being beneficial, does not make the classification right. It also made clear that classifications adopted under the erstwhile indirect tax regime, namely excise, are not relevant for determining correct classification under the new GST regime

“I am of the view that ‘Flavoured Milk’ that was proposed to be manufactured by the petitioner at the time of institution of the Writ Petition has to still be classified under Tariff Heading 0402 of the Customs Tariff Act, 1974 and is, therefore, liable to Central Tax at 2.5 per cent (5 per cent after adding SGST at 2.5 per cent) in terms of Entry 8 to the First Schedule to Notification No.1/2017-CT(Rate) dated 28.06.2017,” the bench said. However, the Central Government can either tweak the rate on the recommendation of the GST Council or by itself.

GST Council cannot determine classification; Allows writ on ‘flavoured milk’ controversy

➡️ Wrong Classification of Flavoured Milk: The Madras High Court addressed a case where Parle Agro challenged the classification of ‘flavoured milk’ under HS Code No. 2202 instead of HS Code 0402, which would result in a lower GST rate of 5% instead of 12%.

➡️ GST Council’s Limited Authority: The court asserted that the GST Council does not have the authority to determine the classification of goods, emphasizing that this falls outside the purview of the Council.

➡️ Customs Tariff Act Determination: The High Court analyzed the GST law, the charging section, and the historical practice of classification under the Customs Tariff Act. It concluded that ‘flavoured milk’ should be classified under Tariff Heading 0402, attracting a 5% GST.

➡️ Interpretation of ‘Beverages Containing Milk’: The court scrutinized relevant notes in the Customs Tariff Act and applied the principle of “Nosciter – a sociss” to conclude that ‘Beverages Containing Milk’ pertains only to plant/seed-based milk with alcohol, excluding dairy milk-based flavoured milk.

➡️ Rejection of Previous Indirect Tax Classifications: The High Court rejected past classifications of ‘Flavoured Milk’ under the Central Excise Act, deeming them erroneous. It emphasized that previous classifications under the Excise Act are irrelevant for determining the correct classification under the new GST regime. The court allowed the government to issue a fresh notification to adjust the tax rate if needed.

✔️ M/s.Parle Agro Pvt. Ltd. vs .Union of India & Ors.

[TS-577-HC(MAD)-2023-GST]

Source : The Hindu Businessline 14th Nov 2023 with some syndicated feeds from social media