Highlights

- Higher raw milk prices impacted the performance

- Value-added products saw higher growth

- The March 23 quarter performance also likely to be impacted

- Investors with a longer-term view can add and accumulate on declines

The December ’22 quarter results of Heritage Foods (HFL; CMP: Rs171) were below expectations. Companies in the dairy segment continued to remain impacted by higher raw milk prices. Value-added products contributed around 29 percent to the revenues for the 9-month period ended December ’22 against 40 percent targeted for the next 3-4 years.

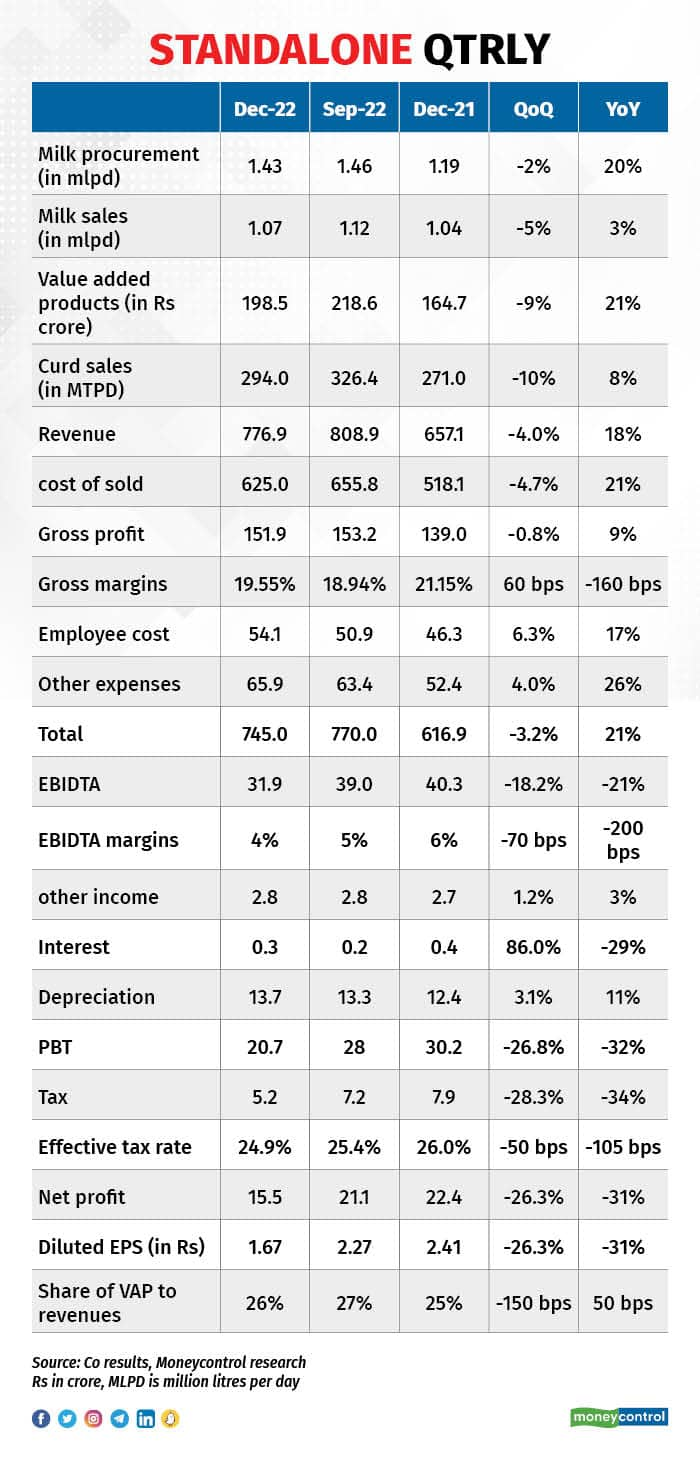

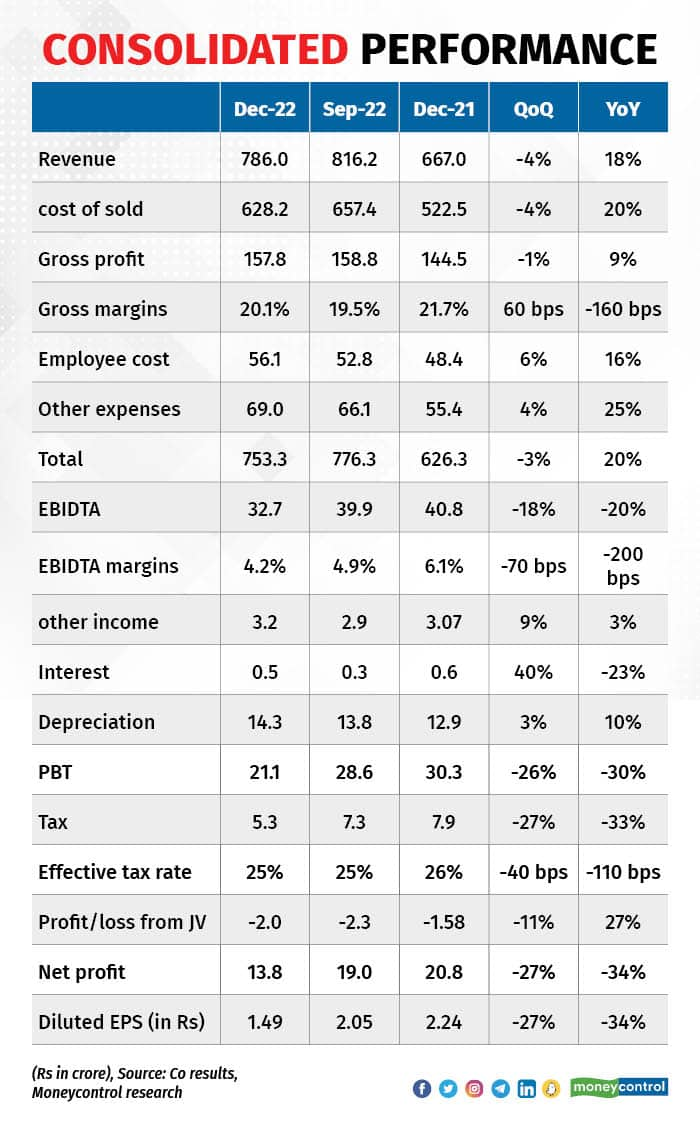

December ’22 quarter results

Milk procurement and sales both saw double-digit growths year on year. Milk procurement price increased 14 percent year on year, while the hike in selling prices was around 17.5 percent. The decline in gross and EBITDA margins was mainly due to the increase in raw material costs and the inability to pass on the full impact of the price hikes to consumers. The flush season was adversely affected by the lumpy skin disease and the prolonged monsoon season in south India, which put pressure on the milk procurement prices. Higher spend on advertisement and publicity also impacted profitability.

Capex for the nine months ended December ’22 was Rs 55.5 crore. HFL has guided to a capex of Rs 100-120 crore per annum going forward.

Products launched during the quarter: HFL introduced several new products — Mawa Kulfi ice-cream in bars, Matka kulfi ice cream in Matka, chocolate Doodhpeda, Gluco shakti, instant whey energy drink, and creamilicious curd. The introduction of new products in the value-added segment will lead to higher revenue and earnings growth.

Outlook and Valuations

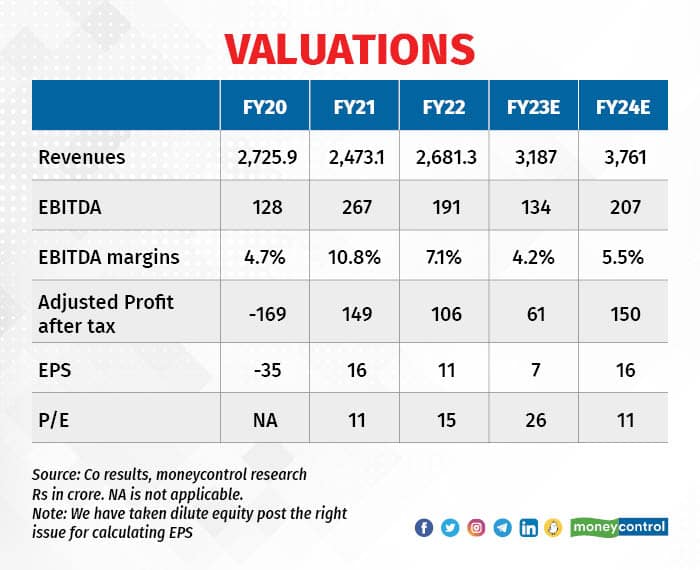

In FY23, HFL is likely to report one of the lowest EBTIDA margins in the last 8 years, given higher inflation in raw milk prices and the inability to pass on the full impact to consumers. However, HFL has consistently delivered revenue growth in double digits for the last 5 quarters and the share of value-added products has increased. HFL is in a very sweet spot given the consumer reach, brand loyalty, and sound financials. With higher revenue growth and an increase in contribution from value added products, we expect margins to recover on the back of an operating leverage while value added products have margins of nearly 1.5-2x compared to milk.

The EBITDA margins for the March ’23 quarter is also likely to remain lower as inflation in raw milk prices is yet to abate and the flush season has been weak. We expect the margins in FY24 to recover as raw material prices subside and the increase in value-added products kick in.

HFL has appointed Srideep Kesavan as CEO in June 2021, who has rich experience of more than 2 decades, having worked with Coca-Cola and others.

We have lowered our net profit expectations for FY23 and FY24 by around 29 percent and 8 percent respectively. We remain positive on Heritage for the long term and recommend investors to add at current levels and accumulate on decline. Historically, HFL in the last 10 years has traded in the P/E basket of around 18-20x, while it is trading at half that valuation now. HFL is trading at much cheaper valuation compared to peers.

Risk to our assumptions is inability to increase milk prices, milk procurement issue on the back of higher competition, and political connections (HFL is promoted by ex-chief minister of Andhra Pradesh N. Chandrababu Naidu and his wife is Vice-chairperson and managing director at HFL).

Source : Money control Jan 27th -2023 by Nandish Shah