In March 2022, a full-cream packet of Amul milk cost ₹60/litre. The one-litre pouch now costs ₹66. Since 2021, milk prices in India have been on a boil. Prices have been hiked across brands and the recent hike in February 2023 was Amul’s fifth increase since 2021.

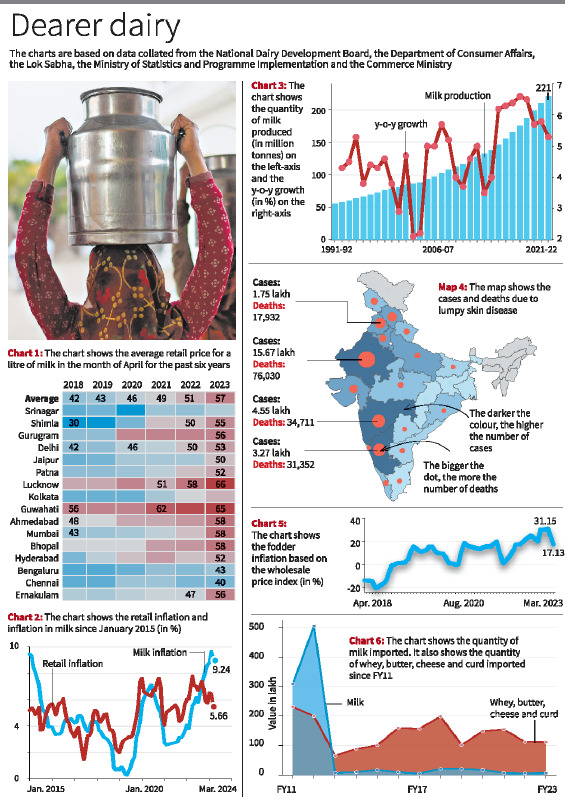

In April 2023, the average price for a litre of milk in India was ₹57, which is about 12% higher than ₹51 in April 2022. The average milk price is the highest in Lucknow and Guwahati at ₹66/litre and ₹65/litre, respectively. Southern cities such as Bengaluru and Chennai have relatively lower milk prices.

In the past year, Ernakulam saw the highest rise in milk prices at 19%, followed by Mumbai, Lucknow and Jaipur which saw over 10% rise. Chart 1 shows the average retail price for a litre of milk in the month of April for the past six years.

The Central Bank’s monetary policy committee, which met in the first week of April, said in a statement that high inflation in milk was one of the reasons driving retail inflation. While retail inflation slowed to 5.66% in March, milk inflation continued to tread higher. In the same month, milk inflation was at 9.24%, close to the levels last seen in February 2015. Chart 2 shows the retail inflation and inflation in milk (liquid, litre) since January 2015.

At the same time, there have been concerns over the country’s stagnant milk production in FY23. On April 5, Secretary for Animal Husbandry and Dairying Rajesh Kumar Singh said the country was facing stagnation and that the government would consider all options, including the import of butter and ghee if the situation remained unchanged.

However, days later, the Union Minister for Animal Husbandry and Dairying Parshottam Rupala contradicted him and ruled out stagnation in milk production and the government’s decision to consider import of butter and ghee.

In FY22, India produced 221 million tonnes of milk, about 5.3% higher than in FY21. While there has been a rise in the absolute quantity of milk produced, the y-o-y growth has slowed. It peaked at 6.6% in FY18. Chart 3 shows the milk produced (in million tonnes) and the y-o-y growth.

According to Mr. Singh, the country’s milk production in FY23 would either be stagnant or grow at 1%-2%. Multiple factors have resulted in the stagnation of the country’s milk production. Initially, dairy farmers faced a demand slump due to COVID-19. As demand recovered, the outbreak of lumpy skin disease hit the cattle and buffalo herd, resulting in lower milk yields. High prices of fodder have also raised the cost of production.

According to an answer in the Lok Sabha, 32.8 lakh cattle were affected by the disease and 1.86 lakh succumbed to the disease. Rajasthan, the second largest producer of milk, saw the highest number of cases and cattle deaths. Close to 50% or 15 lakh cases and 76,000 cattle deaths were reported in Rajasthan, as shown in Map 4. While the fodder inflation based on the wholesale price index eased to 17.13% in March, the figure has remained in double digits for 14 months now, as shown in Chart 5.

Finally, coming to Mr. Singh’s remarks about the possibility of import of dairy products, it must be noted that India is the largest producer of milk in the world and accounts for 24% of the milk produced worldwide. As shown in Chart 6, India last imported a significant quantity of milk in FY12. Since then, milk imports have slumped. While India continues to import whey, butter, cheese and curd in relatively higher quantities, the share of milk in India’s import basket is significantly lower.

Source : The Hindu April 20th 2023 by Jasmin Nihalani