Dairy advisers have warned of future shortages of milk, with little to no growth in production in many major exporting regions, despite a surplus at present.

Global demand is mixed, with a softening requirement reported in Europe and the US, and a slow recovery from China, but there are some growing opportunities from other Asian markets.

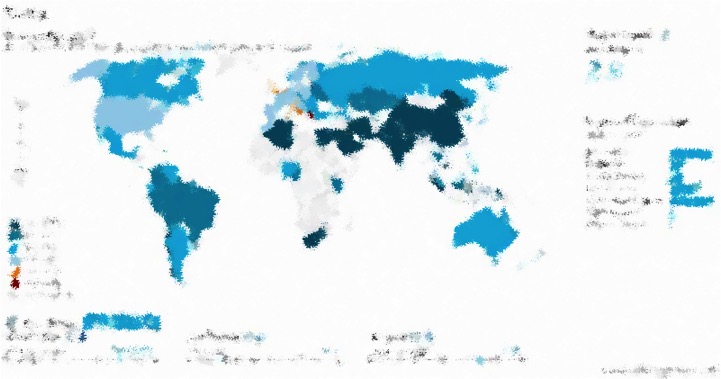

The EU, New Zealand and the US account for more than 75% of global dairy trade, with the US market share growing each year, while the EU and New Zealand shares are declining.

Milk production has moved into a surplus position globally during the past 12 months, according to Joanne Bills, director at Australian analyst FreshAgenda.

However, production in all of the big five exporting regions is slowing, Ms Bills told the Dairy Industry Newsletter conference in London on 18 May.

Demand

Weak cheese demand in Europe has pushed more milk into skimmed milk powder production and butter, said Ms Bills.

EU mozzarella production is up and competing with US mozzarella at present, she added.

Asia accounts for about 50% of global demand, according to Jukka Likitalo, secretary general at European dairy analyst and trade body Eucolait.

Mr Likitalo said Indonesia and the Philippines had seen the largest growth in demand in recent years.

“Both countries have a low self-sufficiency rate and rapidly increasing per-capita consumption, so there is a lot of potential still, mainly for powders,” he added.

China

China is traditionally a major global importer of milk products, but has not been taking as much product of late, with an abundant home supply. Analysts say this is forecast to continue into the second half of 2023.

Reduced sow numbers in China due to African swine fever has meant there has been less demand for whey products in the country.

However, recovery in the Chinese food-service sector should help to boost exports of cheese and butterfat.

Australia

There is a significant milk shortage in Australia because milk production is declining, despite three years of good seasonal conditions and high milk prices, said Ms Bills.

“Australian prices have become quite detached from the world market, even though Australia is still a major exporter.”

Ms Bills added that Australia is “chronically short of fat”, which has meant cream prices are supporting manufacturing returns and therefore pushing up farmgate prices.

New Zealand

Major global exporter of dairy products, New Zealand is focusing on Asian markets, particularly for high-value export products.

“Globally, high-value demand is growing faster than supply,” said Miles Hurrell, chief executive at New Zealand-based dairy co-operative Fonterra.

Mr Hurrell welcomed the free-trade agreement between the UK and New Zealand, which comes into force on 31 May. However, he added that Fonterra does not see significant volumes of product coming from New Zealand to the UK.

Milk production has been flat or declining in New Zealand for three years and could potentially decrease further, he added.

US

Unlike many of the major milk-producing countries, the US is forecast to continue to grow its milk production and export volumes.

Martin Bates, representing major US co-operative Dairy Farmers of America, said the US is expecting a 1.5% year-on-year increase in milk volumes.

US milk consumption is growing at about 0.5% a year.

Europe

About 145m tonnes of milk is produced in the EU, and the EU exports some 20% of its milk solids, according to Mr Likitalo.

“In the longer term, milk availability will be a big concern, certainly from a European perspective,” he said.

A larger share of EU milk is expected to shift towards cheese and whey products in the coming years.

Ukraine

The war is having a huge effect on the dairy industry in Ukraine, with a 28% drop in consumption, huge cost increases and inflation.

Maks Fasteyev, analyst at Ukrainian firm Infagro, said broken supply logistics, blackouts and landmines all posed major issues for Ukrainian dairy farmers.

Despite the effect of the war, Ukraine is forecast to increase its milk supply by an additional 3-5m litres during the next decade.

Source : Faremers Weekly UK MAy 23 2023