The current extended period of milk-production growth has so far been the weakest of all such periods since 1996, but prices continues to decrease even as inflation ebbs and consumer demand for dairy products recovers. Production of most major categories of dairy products mirrored that modest growth of milk production. Growth in total domestic consumption during this year’s first quarter kept pace with both milk-production and milk-solids production growth. Total export growth was positive during the quarter, compared to the previous year, which set a new calendar-year record.

The volume of milk solids imported into the country in December 2023 exceeded 4 percent of domestic production for the first time since 2016. But it has since returned to the 3 percent to 3.5 percent range, typical for monthly import volumes since 1995.

Retail-price inflation that hit dairy products hard during 2022 has been quickly unwinding in recent months, as measured by annual change in the various consumer-price indices. The Dairy Margin Coverage margin has approached $6 per hundredweight in March, the smallest levels since summer 2021.

Commercial Use of Dairy Products

Domestic yogurt consumption has returned during this year’s first quarter to the strongly-positive growth it achieved during the first two years of the pandemic, after dropping in 2022.

Domestic butter consumption has also strongly rebounded during February and March from the previous year’s mostly depressed levels, when it became a poster child for runaway retail-food-price inflation. Growth in total milk consumed domestically in all products continued to be positive by all measures during the first quarter, particularly as measured by fat-basis milk equivalent. On a total solids-milk-equivalent basis, it was on par with both milk-production and milk-solids production growth.

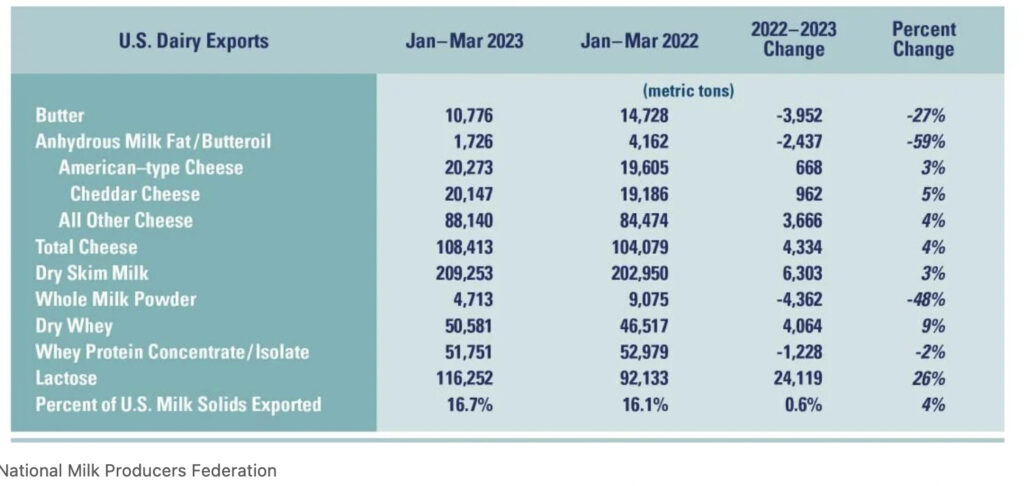

U.S. Dairy Trade

U.S. exports of many of the major product categories increased – compared to a year earlier – by modest percentages during this year’s first quarter. Total exports showed gains in milk solids, both total as well as percent of first-quarter domestic-milk-solids production. The average unit value of milk solids imported into the United States during the first quarter of 2023 was $5.44 per pound. Thirty-two percent of those total milk-solids imports were concentrated-milk proteins, both milk-protein concentrate and casein, with an average unit value of $4.11 per pound. Another 20 percent was cheese, with an average unit value of $6.88 per pound.

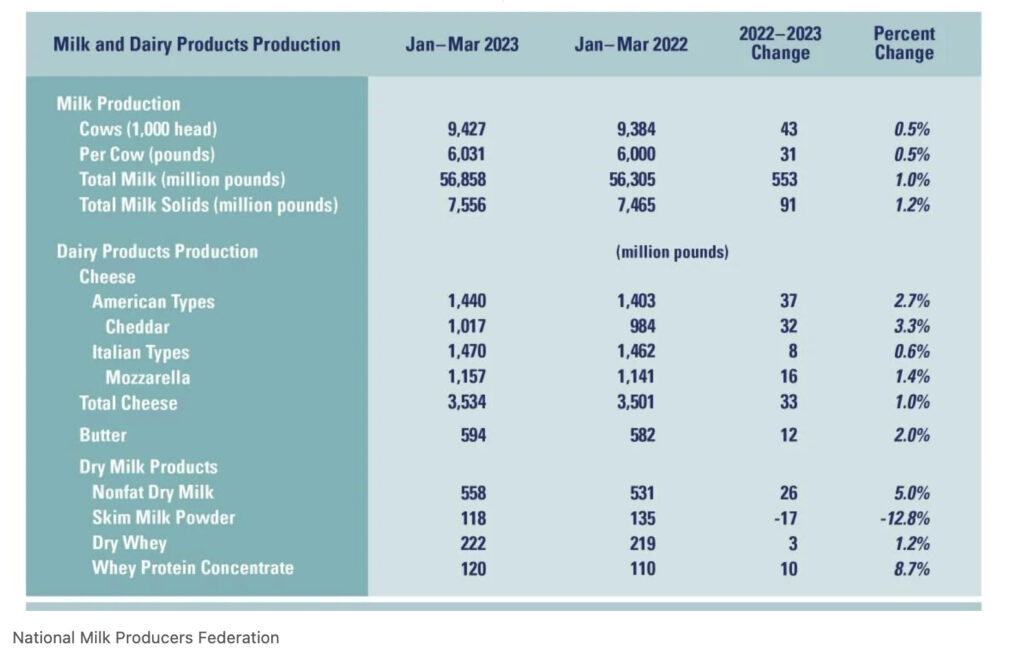

Milk Production

Annual milk-production growth since July 2022 has been positive but weak. Since 1996 there have been 10 similar episodes when U.S. annual milk-production growth switched from negative to positive – and thereafter stayed positive for at least the next nine months. Growth during those following nine-month periods averaged from 1.28 percent to 2.70 percent. The current one has averaged 0.96 percent, with few states showing anything like breakout increases in production. U.S. total milk-solids production increased just 0.2 percent faster than total milk production during the first quarter.

Dairy Products

Production of most of the key dairy-product categories was mostly at more than year-ago levels by small-single-digit percentages during the first quarter. A notable exception was a small-double-digit percentage decrease in skim-milk-powder production, which is mostly destined for export when made in this country.

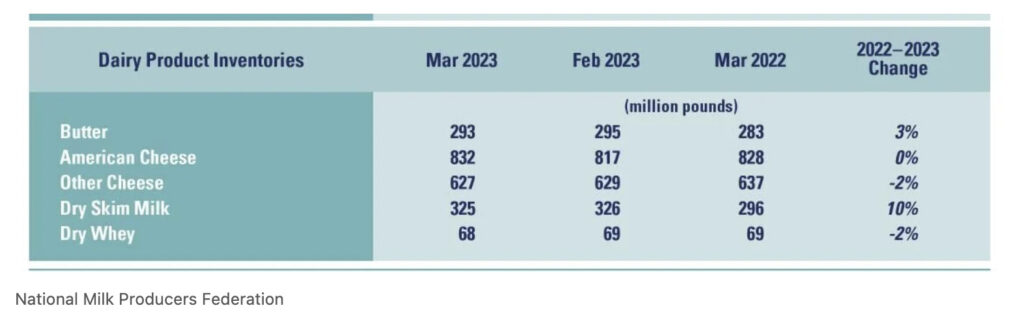

Dairy Product Inventories

End-of-month inventories of the key dairy products at the end of March were mostly little changed from both a month earlier and a year earlier. March-ending American-type-cheese stocks returned to their average level for the past several months, following a one-month dip at the end of February. Manufacturer stocks of dry skim milk have generally averaged about 300 million pounds for the past six years, with periodic but relatively short forays to more than that level.

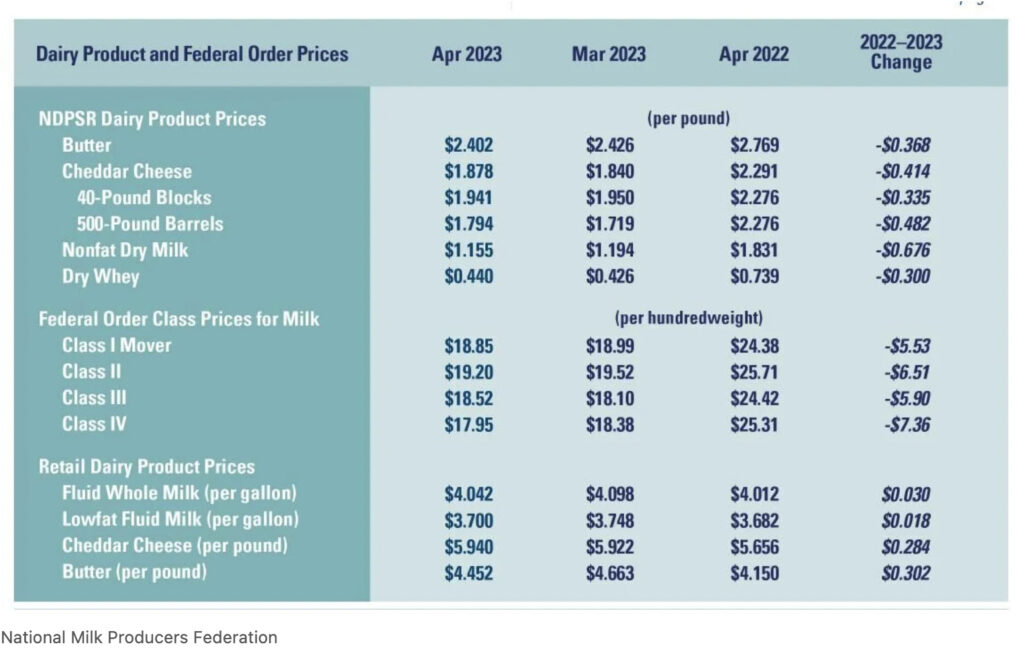

Dairy Product, Federal Order Class Prices

Class III and Class IV prices switched places from a month earlier in April, as Class III increased by almost the same amount as Class IV decreased. Cheese and dry-whey prices increased, while butter and nonfat dry milk declined.

Fluid milk, which led the previous year’s increasing retail-price inflation for dairy products, is now leading it back to lesser prices. In January 2022 the consumer-price index for all fluid milk was 6.8 percent more than a year earlier, while the overall consumer-price index for all dairy products increased by 3.1 percent. After maxing out at 17 percent in August 2022, by April this year the fluid-milk consumer-price index was just 1.6 percent more than a year ago. In contrast the overall dairy consumer-price index was still 8 percent more than a year earlier in April, after hitting a maximum of 16.4 percent this past November. Butter was dairy’s most volatile inflation performer, starting 2022 at just 3.7 percent more year-over-year, peaking at 31.4 percent this past December, but decreasing to just 5 percent by April.

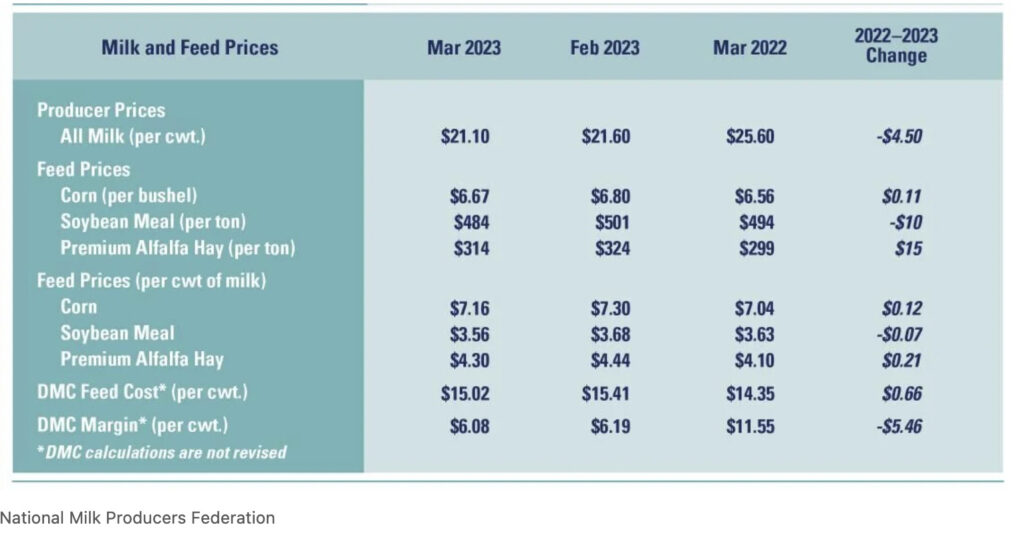

Milk, Feed Prices

Following three straight months when the Dairy Margin Coverage margin decreased by well more than $1 per hundredweight, the margin decreased again in March, but by just 11 cents from February. The milk price decreased again for the fifth month in a row, to $21.10 per hundredweight. That’s $0.50 per hundredweight less than the month before, but feed costs were less by almost as much at $0.40 per hundredweight. It was the first monthly decrease on the Dairy Margin Coverage feed cost since this past November. The reduced feed costs were driven almost equally by decreases in the prices of all three feed components of the formula, when expressed on a milk-equivalent basis. The March Dairy Margin Coverage margin of $6.08 per hundredweight will result in a payment of $3.42 per hundredweight for Tier 1 coverage at the maximum $9.50-per-hundredweight level.

Looking Ahead

The U.S. Department of Agriculture’s World Agricultural Supply and Demand Estimates report always adds the following year starting with its May update. This year’s initial forecast calls for 2024 annual milk production to grow by 1 percent from this year, or 0.7 percent when adjusted for leap year. It also reduced its 2023 growth forecast to 0.9 percent more than the previous year. The department currently expects this year’s modest milk-production expansion to extend through next year.

The May World Agricultural Supply and Demand Estimates report continues to be bearish regarding milk prices. It further reduced its U.S. average all-milk price calendar-year estimate for this year to $20.50 per hundredweight. That’s a decrease of almost $5 per hundredweight from calendar-year 2022, and forecasts the 2024 annual average at $19.90 per hundredweight. At the same time, the dairy futures were indicating 2023 and 2024 calendar-year average U.S. all-milk prices at $21.15 per hundredweight and $21.30 per hundredweight, respectively.

The same futures were still indicating that the monthly Dairy Margin Coverage margins were close to bottoming out for the year, at about $6 per hundredweight this spring, followed by a slow increase that’s unlikely to exceed $9.50 per hundredweight until the fourth quarter.

Peter Vitaliano is with the National Milk Producers Federation, a farm-commodity organization representing most of the dairy-marketing cooperatives serving the United States.

Dairy Management Inc. and state, regional and international organizations work together to drive demand for dairy products on behalf of America’s dairy farmers, through the programs of the American Dairy Association, the National Dairy Council and the U.S. Dairy Export Council.

Source : AgUpdate June 15th 2023