China’s demand for dairy products plays a pivotal role in setting the price direction on global dairy markets. Back in 2013 and 2014 they bought above expectations, which contributed to the collapse in global dairy prices when import demand slumped in 2015.

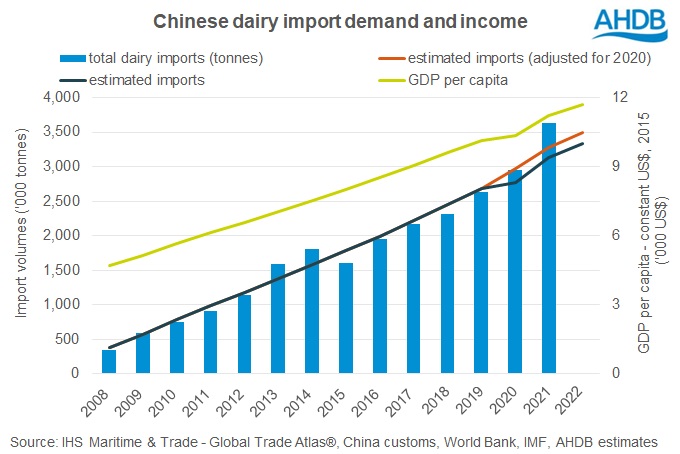

Historically there has been a strong relationship between China’s economic growth (as measured by GDP per capita) and its level of dairy imports. So much so that comparing the two trends can give an indication of whether import volumes are in line with demand, or contributing to stock building and posing a risk that import demand will fall away.

China’s buying unexpectedly strong in 2021

Although rising input costs and tight supplies are considered to be the main factors driving high dairy prices since summer 2021, demand has also been important. Strong demand, sustained even at higher prices, supported the market through 2020 and 2021, and China’s import demand played a central role in this.

In 2020, the pandemic curbed China’s GDP growth but didn’t seem to dampen import demand. Contracted shipments, plus the build-up of safety stocks to deal with logistical delays, appear to have kept imports on track with rising incomes. In 2021, China’s GDP growth bounced back despite the lingering effects of the pandemic. As for imports, they rose 23% year on year, far outstripping GDP-based expectations.

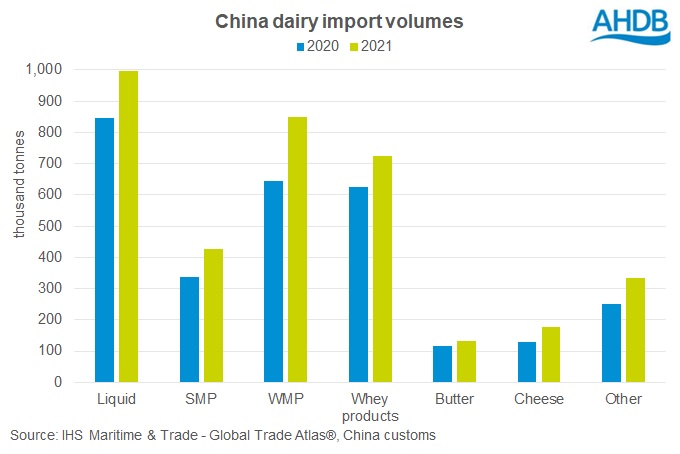

When we analysed this a year ago , the balance of products showed growth in liquid milk and whey but not in powders. This shifted in 2021, with liquid and whey products still growing year on year, but milk powder imports also seeing a large uplift, particularly for WMP.

What does this mean for China’s import demand later this year?

Based on China’s predicted economic growth (1) of 4.4% for 2022, import volumes were expected to increase by around 6.5% this year. However, this doesn’t account for the higher-than-expected level of imports in 2021. The build-up of safety stocks will account for some of these additional import volumes, but if manufacturers now start to use these stocks, import buying could be dented through 2022.

So far this year, we have seen a drop in dairy imports, with Q1 2022 volumes down 12% on Q1 2021.. Imports of powders and concentrates still rose in the period, as did butter volumes, while all other product categories saw lower volumes year on year. For milk powders, this is a particularly important period as China generally makes its biggest purchases at the start of the year when they can take advantage of low tariff rates.

Going forwards, it is possible that we will see a drop-off in demand if China now considers itself sufficiently stocked, particularly due to lower consumer buying as parts of China are again facing lockdowns.

Although there is a delay to trade data, we have seen signs of reduced demand in the falling prices at GDT auctions . Additionally, according to Rabobank, “local market prices of imported WMP have also recently weakened due to ample stock and uncertain demand”. As a result, Rabobank are expecting China’s appetite for imports to be dampened in the second half of 2022.

Conclusion

There are some signs that a reduction in demand from China could be forthcoming, whether due to ample supplies or lower demand. If realised, this would put downwards pressure on markets and limit further upward moves in dairy product prices. However, with high inputs costs Keeping global milk expectations tight, this will provide help to counterbalance some of that downwards pressure.

(1) Data fro Inernational Monetary Funds

Source : AHDB May 18th 2022, by Katherine Jack

![Based on China’s predicted economic growth[1] of 4.4% for 2022 import volumes were expected to increase by around 6.5% this year.](https://dairynews7x7.site/wp-content/uploads/2022/05/chinese-dairy-demand-in-2022-dairynews7x7.jpg)