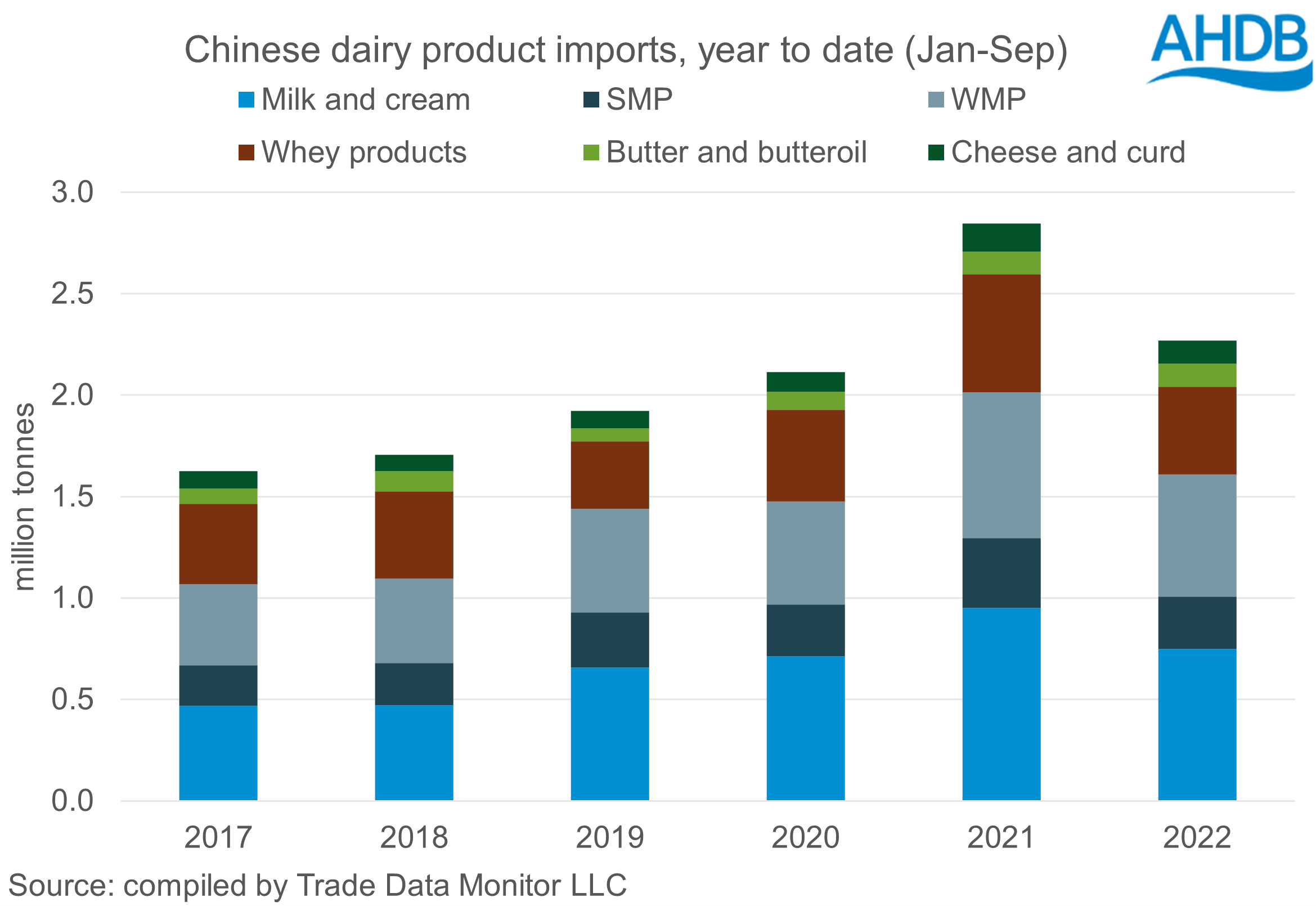

Demand in China for dairy imports is in decline as the country faces a sharp slowdown in economic growth. Historically there has been a strong relationship between China’s economic growth and its level of dairy imports. For the year to date (Jan-Sep) China has imported 2.3million tonnes of dairy products, a 20% drop year on year and the first decline seen in the last 5 years. Reduced demand from China has reportedly contributed to softer prices on global markets as competition for available supplies eases.

All product categories have seen declines in year-to-date volumes imported, except for Butter and butteroil where a marginal 1% gain has been seen, due to demand from the bakery sector. Ongoing restrictions as part of the covid-zero policy mean demand for cheese and curd has fallen, as it relies more on the hospitality sector, with imports seeing an 18% year on year decline.

Domestic milk production is reported to have increased in 2022 due to a larger herd and government drive to increase self-sufficiency. This increased production teamed with the impact of continued covid lockdowns has meant less fresh product has been required. This has led to milk and cream seeing the largest year on year decline in volume terms, with over 200,000 tonnes less product imported.

A knock-on effect of this increased production and lowered demand for fresh product, is that domestic processors are expected to be increasing production of WMP to limit losses, according to USDA. Imports of WMP are down 120,000 tonnes (17%) compared to a year ago. Additionally, SMP imports were down 24% (83,000 tonnes). In China, SMP and WMP are often interchangeable as food ingredients and so consumption of imported SMP is likely lower in 2022 due to higher stocks and production of WMP, thus reducing SMP imports.

Nearly all key exporting nations have recorded declines in volumes of dairy products shipped to China in 2022. The EU has seen the largest fall, down 31% compared to the same period in 2021. It is likely this is a result of both the weakened demand but also uncompetitive pricing, as lower milk production on the continent causes reduced availability of exportable supplies. New Zealand remains the largest supplier of dairy products to China, providing just over 1.0 million tonnes so far in 2022, 14% behind volumes seen a year ago. Volumes from the US are down 4% year on year, while Australia is the only key nation to see growth, albeit marginal at 1%.

Source : AHDB 10th Nov 2022 by Freya Shuttleworth