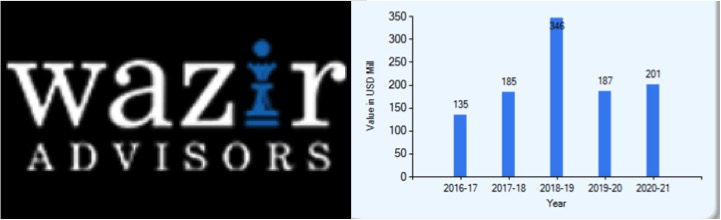

India may see dairy exports growing significantly in the next decade. A latest research report by an independent consulting player Wazir Advisors stated that India is uniquely positioned to capitalise on the emerging opportunities in dairy products in the international markets.

Large international markets such as the US, Canada, and New Zealand are witnessing a stagnation in dairy production, while the consumption is likely to grow – thus, there is an increased export opportunity, noted the report for December 2021. Further, Japan, the Russian Federation, Mexico, West Asia, and North Africa will continue to be important net importers.

Quoting the OECD-FAO Agricultural Outlook for 2021-30, it says India along with Pakistan will contribute over 30 per cent to the global production in 2030.

‘Unique position’

World’s largest milk producer, India’s produced all time high 198.4 million tonnes of milk in 2019-20 with per capita milk availability further increasing to 407 grams per day. “Overall, India finds itself in a unique position for the next 10 years with both production and market estimated to grow. This augurs well for all participants in the value chain, especially since major growth will come from value-added products,” the report said.

The global per capita consumption of fresh dairy products is projected to increase by 1 per cent per annum over the next decade. The EU is currently the largest market for processed dairy products followed by the US. The trend is likely to continue over the next decade, the report noted.

But the share of value-added dairy products is about 30-35 per cent of the total milk and milk products’ markets, which the government wants to take to 40 per cent by 2025. Rabobank in its 2021 report has estimated 15 per cent annual growth rate for value-added products, which include segments such as cheese, fermented milk, butter, cream, condensed milk and whey, among others.

As per the Wazir Advisors’ report, ice creams command the largest share in value terms in the value-added segment, followed by yogurt, baby food, and cheese. Margins are high in products such as whey products, ice cream and UHT milk with 20 per cent or more, cheese and yogurt have at least 15 per cent margins followed by flavoured milk and butter milk with minimum 12 per cent margin. Quoting a Crisil data, the report says that price margin for liquid milk is about 3-5 per cent.

For India, the domestic consumption of fresh and processed dairy products would dominate, thereby limiting the opportunity for international trade. But it noted that the rate of increase in India’s share in international trade will depend upon how quickly India is able to address challenges related to productivity and efficiency.

In the post-pandemic market, the consumption pattern for dairy products in India has changed for higher household and retail segment consumption. Packaged dairy products are more in demand now, the sale through e-commerce and digital apps is growing, also the household sales has increased at the cost of institutional sales.

“While in the past, the organised dairy market was dominated by dairy cooperatives, the private sector has gained prominence over the last few years. Today, the share of milk handled by the private sector has exceeded that of the cooperative sector,” the report noted pointing at the growing organised private sector interests in the traditionally unorganised or cooperative-dominated dairy space.

Source : Business Journal Jan 11th 2022