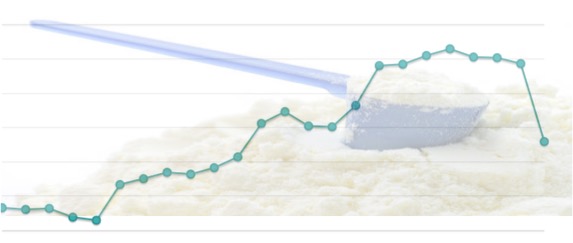

The global dairy trade price index dropped 2.9 per cent from the previous auction a fortnight ago. The index is sitting 19 percent higher than at the same time last year after sharp gain earlier this year.

The average price for whole-milk-powder, which has the most impact on what farmers are paid, fell 3.8-percent-to-an-average-US$3730 a tonne; and sits 16 per cent higher than at the same time last year. Skim milk powder fell 5.3 per cent to an average US$2971/t; and is 11 per cent higher than a year ago.

“These are some sharp price drops, with both of the milk powders seemingly in free-fall at this point;” said NZX dairy analyst Stuart Davison. “But at the same time, we are coming off of price highs; and there was going to be a point where markets started to balance; this seems to be what we’re seeing now.”

China’s dairy demand

The earlier spike higher in dairy prices was largely as a result of demand from China where a wealthier population and increased focus on health and wellbeing after the Covid-19 pandemic stoked demand for better nutrition. The strong demand relative to supply prompted Fonterra to offer a record opening price of milk for farmers this season.

Fonterra factors in fat and protein levels in milk when buying it off farmers.

The co-operative’s opening forecast for the farmgate milk price is between $7.25 per-kilogram of milk solids to $8.75 per kgMS; with a mid-point of $8 per kgMS. Its previous highest ever opening price was $7 per kgMS.

“This result will have a negative-effect-on-the-farm-gate milk price forecast and will put a dampener-on-the season’s-outlook for farmers on the ground.”

Prices fell at the latest-auction-for every commodity traded except-cheddar; and demand for both milk powders was below levels seen at the last auction, he said.

ASB economist Nat Keall lowered his farmgate milk price forecast to $7.90 per kgMS, from $8.20 per kgMS, following the auction.

Future delivery

Prices on the auction platform for future delivery dates had shifted from being broadly flat to “a marked downward slope,” Keall said.

“It’s a clear sign that prices are now losing momentum as we get deeper into the season and may reflect the fact that stockpiles are now much better covered after the frenzy earlier in the year,” he said.

While he had not expected the high prices to be sustained, they were falling faster than he had anticipated, Keall said.

Westpac senior agri economist Nathan Penny said the overnight price drop and increased uncertainty around Covid-19 due to the delta variant and a global resurgence in Covid cases introduced downside risks to his forecast for this season of $8 per kgMS.

“The renewed Covid concerns have clouded what was previously a very rosy picture,” Penny said. “It will take some time to digest what this means for dairy markets and prices.

Risks to the milk prices

“We’ll be keeping a close eye on Covid and dairy demand developments over the coming weeks, with a particular focus on key dairy markets in Asia.”

The risks to the milk price had clearly shifted to the downside, he said.

Penny noted that prices fell even though Fonterra had reduced the volume it offered on the platform. Normally that would have led to a temporary lift in prices, he said.

The European Union is coming off its peak milk production period, while New Zealand is heading into its peak milk production months.

It appeared that the New Zealand winter had been colder than in recent seasons, and when combined with a lack of winter feed, that could mean a quiet start to production, he said.

Source : Stuff New Zealand July 21,2021