What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we’ll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don’t think Dodla Dairy has the makings of a multi-bagger going forward, but let’s have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you’re unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Dodla Dairy, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.13 = ₹1.3b ÷ (₹13b – ₹2.2b) (Based on the trailing twelve months to March 2023).

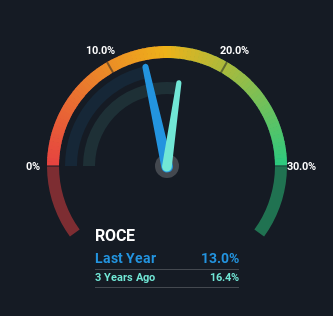

Therefore, Dodla Dairy has an ROCE of 13%. In absolute terms, that’s a pretty normal return, and it’s somewhat close to the Food industry average of 12%.

Above you can see how the current ROCE for Dodla Dairy compares to its prior returns on capital, but there’s only so much you can tell from the past.

What Does the ROCE Trend For Dodla Dairy Tell Us?

When we looked at the ROCE trend at Dodla Dairy, we didn’t gain much confidence. Around five years ago the returns on capital were 22%, but since then they’ve fallen to 13%. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a side note, Dodla Dairy has done well to pay down its current liabilities to 17% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business’ efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Key Takeaway

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Dodla Dairy. And the stock has followed suit returning a meaningful 51% to shareholders over the last year. So while the underlying trends could already be accounted for by investors, we still think this stock is worth looking into further.

While Dodla Dairy doesn’t shine too bright in this respect, it’s still worth seeing if the company is trading at attractive prices.

While Dodla Dairy may not currently earn the highest returns, we’ve compiled a list of companies that currently earn more than 25% return on equity.

Source : Simply Wall St July 21st 2023