Dairy prices jumped 4.6 per cent at the global auction overnight to hit an eight-year-high, as tight milk supply stokes demand for New Zealand’s biggest export commodity.

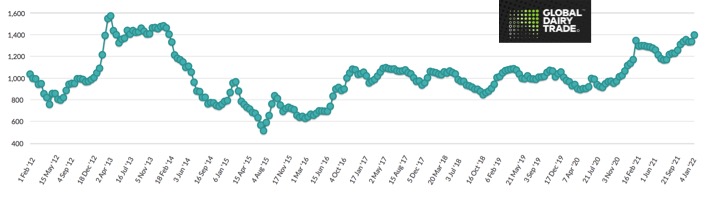

The Global Dairy Trade price index rose to 1397, its highest level since March 2014.

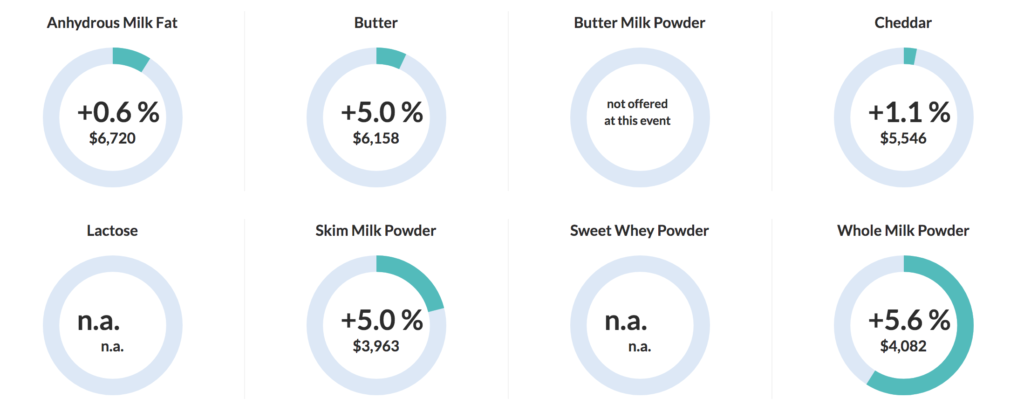

The average price for whole milk powder, which has the most impact on what farmers are paid, posted the biggest gain, up 5.6 per cent to US$4082 (NZ$6041) a tonne, and is sitting 21 per cent higher than at the same time last year.

Global dairy prices have been supported this season by weaker milk production in New Zealand and overseas, hindered by poor weather and higher feed costs. Last week, Fonterra lowered its forecast for the amount of milk it expects to collect this season by 1.6 per cent to 1.5 billion kilograms of milk solids due to challenging pasture growing conditions.

Buyers have “taken full stock of the tightness of milk supply globally and are now increasingly willing to pay the price to secure product,” said NZX dairy insights manager Stuart Davison.

He noted demand was global, with buyers from all regions participating in the auction. North Asian buyers secured well over half of the total volume sold.

The jump in auction prices overnight has prompted some economists to lift their forecast for farmgate milk payments to farmers for this season, which runs to the end of May.

Fonterra’s latest forecast is for a farmgate price of between $8.40 and $9 per kilogram of milk solids. The $8.70 per kgMS midpoint, which farmers are paid off, would be the highest level since Fonterra was formed in 2001 and is expected to contribute more than $13.2 billion to the economy. As the biggest processor, its payment sets the benchmark for competitors.

ASB economist Nat Keall lifted his forecast above Fonterra’s range, to $9.10 per kgMS, from $8.75 per kgMS, noting the “impressive gains” in dairy prices in the latest auction.

“Tight global supply is driving prices higher,” Keall said in a note. “Domestic conditions over the summer have been poor, with hot and dry weather the order of the day in much of the country. With a softer production outlook also evident in Europe and North America, it’s a potent combination for dairy prices – there’s a willingness on the part of buyers to pay big premiums to secure supply.”

Keall said the underlying global dairy demand and supply balance should keep prices supported over the remainder of the season and given that longer-dated contracts were trading at a premium, prices should keep up the momentum over the near term.

“At this stage in the game, a record high milk price for the current season is a practical certainty,” he said.

Still, prices are likely to soften next season and Keall said he will be firming up his forecast over coming weeks.

Meanwhile, Westpac senior agri economist Nathan Penny said the strong auction result cemented his forecast for this season of $9 per kgMS.

“In the short term, the risks to our forecast are mostly on the upside,” Penny said. “Ongoing dry weather could put additional dents in New Zealand production and push prices higher again. Meanwhile, Omicron-related supply chain issues could also lead prices higher.”

Also at the auction, the average skim milk powder price jumped 5 per cent to US$3963/t, butter rose 5 per cent to an average US$6158/t, cheddar gained 1.1 per cent to hit a record US$5546/t, while anhydrous milkfat advanced 0.6 per cent to US$6720/t.

Source : Stuff New Zealand , 19th Jan 2022, Tina Morrison edited by Team Dairynews for pics and title