Global dairy prices rebounded in Wednesday’s auction, but a sustained recovery in rates that have tumbled by a third over the past year is not on the cards due to abundant supply and reduced buying by top importer China, analysts said.

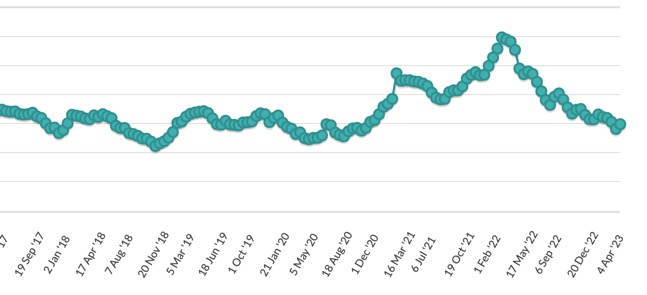

The Global Dairy Trade price index, which is underpinned by prices from the auction held early Wednesday New Zealand time, rose 3.2% to $3,362 a metric tonne, having hit their lowest level since 2020 earlier in April. That is still down, however, from the peak in March 2022 of $5,065 a tonne.

Prices were first hit by the COVID-19 lockdown in China, which reduced demand from the world’s largest importer. However, prices have failed to bounce back even as China has reopened, largely due to the global supply of dairy products remaining high.

Susan Kilsby, agricultural economist at ANZ Bank in New Zealand, said in an April 14 note that demand from China was now improving but that recent purchase levels will not make up for the lack of buying earlier in the season.

“Whilst China was buying smaller volumes on GDT, buyers from other regions increased their purchases. However, we are now seeing reduced demand from regions such as South-East Asia and the Middle East, as they currently have plenty of stock on hand,” she said.

Economists and Fonterra Co-operative Group, the world’s biggest dairy exporter, have steadily lowered what they expect farmers to receive for their milk in the year ending June 1. Fonterra now expects to pay to farmers between 7% and 14% less for their milk this year than they did in 2021-2022.

Dairy analysts at New Zealand exchange NZX said in a note on Wednesday that while there largely seems to have been a jump in demand at this global dairy auction, fundamentals have not changed with global milk production still growing.

“It’s possible that this event is an anomaly,” it said.

Source : Financial Post by reuters April 19th 2023 (Reporting by Lucy Craymer; Editing by Muralikumar Anantharaman)