Global dairy prices moderated at auction on Tuesday night, after a huge lift at the start of March.

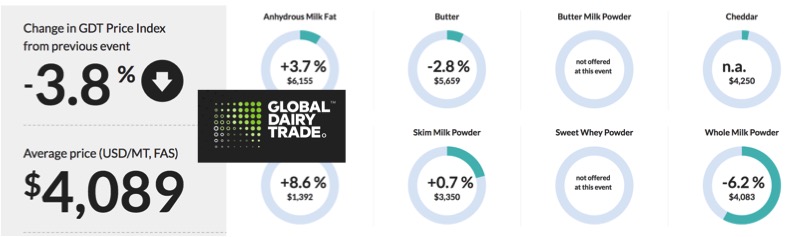

The Global Dairy Trade price index was down 3.8 per cent, wiping out only a small portion of the 15pc rise at the March 2 auction.

The auction results point to increasing volatility in world prices – with the whole milk powder price down 6.2pc, following a 21pc increase at the previous auction.

Disruptions to global shipping and trade are driving some of the demand, as buyers, particularly in China, look to ensure they have adequate supplies.

But the global fundamentals still look good, with pundits forecasting prices to remain firm into the start of the next financial year.

Tuesday night’s auction saw rises in the lactose index (up 8.6pc), the anhydrous milk fat index (up 3.7pc) and the skim milk powder index (up 0.7pc).

The other big mover in the March 2 auction, the butter index, took a small hit, down 2.8pc.

New Zealand bank ASB economist Nathaniel Keall said there was a bit of a correction at Tuesday night’s auction – with the WMP index down by more than the future markets had been indicating.

“Still, prices for products remain very strong,” he said.

“Gains a fortnight ago were so enormous that WMP prices remain well north of $US4000 a metric tonne.”

Mr Keall said aggressive Chinese purchases continued to fuel the strength in prices.

“Stockpiles in China haven’t kept pace with consumption, while food insecurity fears have continued to support demand,” he said.

“The auction a fortnight ago saw shipping disruption fears enter the mix as buyers rushed to secure product, bidding up prices in the process.”

That continued in Tuesday’s auction.

But Mr Keall sounded a note of caution.

“The fact that WMP prices have moved much more dramatically than other products over the past auctions speaks to the fact that while underlying demand for dairy products remains high, shipping fears and the need to reliably secure product for crucial infant formula in the near term are influencing the figures,” he said.

“At a certain point, there remains the risk that China will have built sufficient stockpiles and start to take its foot off the accelerator.

“The timing of such a move remains highly uncertain, and the reentry of other buyers into the market may help offset the price impact.”

Westpac senior agri economist Nathan Penny said he expected dairy prices to remain high, albeit volatile.

“Heading into the 2021/22 season, we expect prices to moderate gradually, but to remain firm by historical standards,” he said.

Mr Penny said prices had posted gains of 25pc or better since the start of the year.

“Dairy markets remain tight, with high prices a function of demand outstripping supply,” he said.

“Also, global supply chain disruptions and the approaching seasonal lull in NZ production continue to add to the upward price pressure.”