Finance Ministry has said that the net impact of GST on various dairy and agro products would be ‘marginal’ because of Input Tax Credit. It also acknowledged receiving petitions for re-consideration of GST on such items.

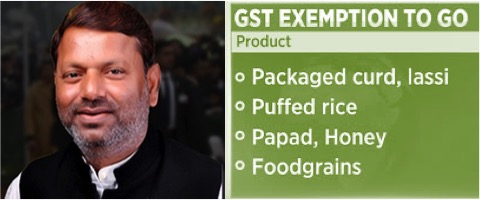

“In case of pre-packaged and labelled form of such commodities, considering that the taxpayer will get input tax credit on the inputs and input services, the net impact of GST will be marginal for consumers,” said the Minister of State in the Finance Ministry, Pankaj Chaudhary, in a written reply in Lok Sabha.

This means, increase in prices would not be a flat 5 per cent on pre-packaged and labelled products such as curd, lassi, butter milk, rice and flour. Also, the supplier of such pre-packaged and labelled commodities eligible for availing threshold exemption or composition scheme would be entitled to exemption or composition rate.

Council’s recommendation

GST Council, in its meeting on July 28-29, recommended imposition of 5 per cent GST on “pre-packaged and labelled” goods such as pulses, rice, flour and paneer. However, when sold in loose food grains, flour, pulses, curd, lassi, buttermilk, paneer continue to remain exempted from GST. These changes have been made effective from the July 18, 2022.

This recommendation has been a topic of major political controversy and has affected the proceedings in the Parliament.

Chaudhary said that, this move by GST Council was unanimous based on the recommendation of the Group of Ministers (GoM) on rate rationalisation.

“Certain representations have been received for reconsidering the levy of GST on the concerned pre-packaged and labelled goods,” Chaudhary said. It may be noted that any change in rate can be possible only on the basis of recommendation by GST Council. The next meeting of the Council is expected to take place next month at Madurai (Tamil Nadu).

GST on Health Insurance

In response to another question, Chaudhary said, proposal for lowering rate on health insurance premium was placed before the Council, in its last meeting. However, it did not recommend any change. At present, GST on health insurance services is levied at standard rate, i.e., 18 per cent.

However, certain insurance schemes catering to poor sections of the society and the differently-abled, such as Rashtriya Swasthya Bima Yojana (RSBY), Universal Health Insurance Scheme, Jan Argoya Bima Policy and Niramaya Health Insurance Scheme are exempted from GST. Exemption has been granted to specific health insurance schemes catering to the needs of economically weaker sections of the society

According to Chaudhary, Health insurance service was standard rated even in pre-GST regime and the same has been continued in GST. In addition, there was significant cascading of taxes in pre-GST regime. Hence, “GST has not led to any higher incidence as compared to the taxes in pre-GST regime,” he said.

Even in its two meetings before last month, the GST Council examined requests to lower rates but did not make any recommendation to reduce GST on insurance service from 18 per cent and on health care insurance policies from 18 per cent to 5 per cent.

Source : The Hindu Business Line July 26th 2022