The average American consumes more than 16 pounds of ice cream each year—but the shopping preferences for American consumers are anything but average. Shoppers are likely to be struggling with new and conflicting priorities every time they walk down the freezer aisle.

Consumers may feel that their families deserve a special treat during a stressful time, for example, but they may also have rising concerns about inflation, grocery budgets, and their kids’ opinions on everything from the newest flavors to multinational versus local ice cream brands. They may want to serve healthier foods, avoid artificial ingredients and genetically modified organisms, support local producers and environmental sustainability, and sample a brand’s new flavor combination—if it obeys local labor laws. When consumers finally reach the dairy aisle, they will weigh other fears and desires while trying to choose among the ever-expanding array of ice cream and yogurt brands, styles, flavors, and packaging options.

Pity the manufacturer that still segments ice cream and yogurt shoppers into a few groups based on only geography, income, and age, or that isn’t ready to meet new preferences emerging faster than ever in today’s personalized marketplace and always-on media environment.

Ice cream and yogurt sales are growing around the world, but in different directions. Most of the growth in ice cream is driven by premiumization, for example, while growth in yogurt is mainly in ethnic and nondairy varieties.

About one in five consumers switched ice cream or yogurt brands in 2021 but not in lockstep: about 20 percent traded down, and 12 to 14 percent traded up, in part because of growing income inequality. Digging deeper, we found that trade-off behaviors depend highly on age. Gen Z consumers overall are more likely to trade down in ice cream and yogurt, for example, but more likely than Gen X or baby boomers to trade up (Exhibit 1).

In this article, we describe how leading producers in these two growing product categories will innovate faster and more profitably based on deeper and more up-to-date insights into consumers.

Overall consumer behaviors and sentiments are changing

McKinsey’s annual global survey of more than 10,000 consumers from 2015 through 2022 reveals changes in consumer behavior during the pandemic. In 2019, fewer than 30 percent of respondents said they were paying more attention to prices, for example, but that share exceeded 50 percent in 2020 and has since declined to about 45 percent. This year, more than half of those who said they traded down on ice cream or yogurt were seeking the same quality at a lower price; while those who traded up in ice cream and yogurt were seeking better taste and more natural or organic products, respectively.

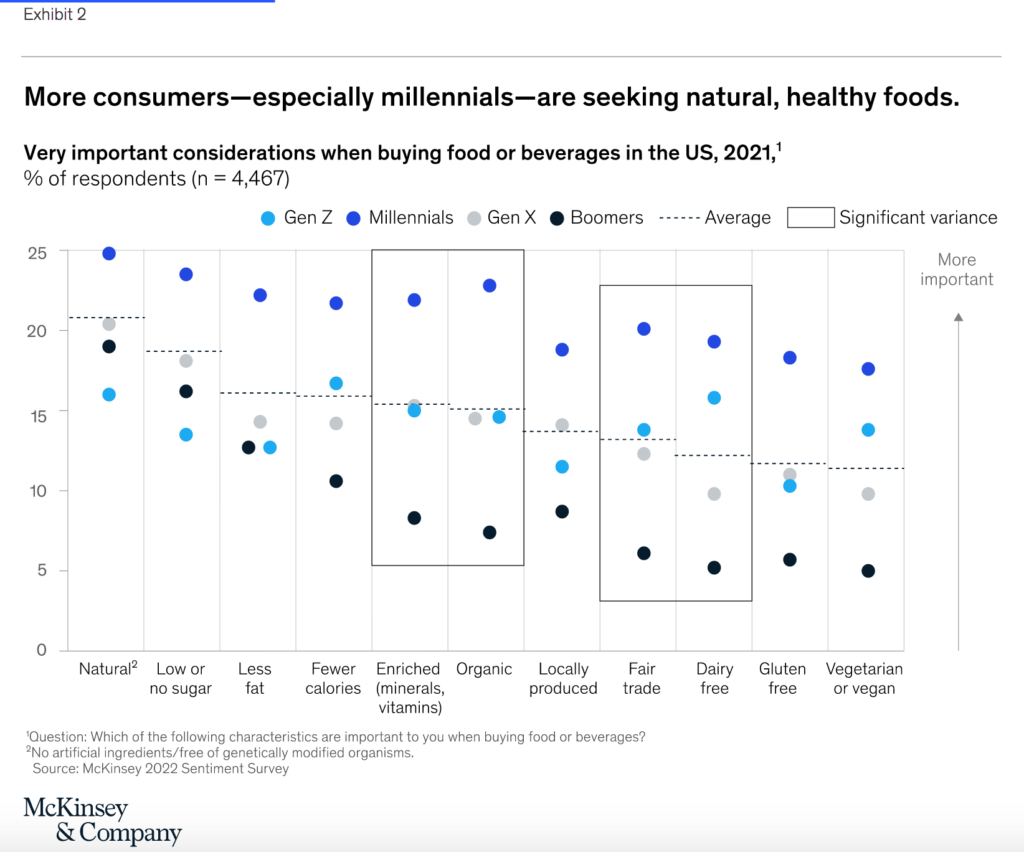

Online grocery shopping spiked, and we expect it to remain higher than prepandemic levels even as the virus wanes. Consumers increasingly sought healthier food—a trend that should accelerate as millennials increase their share of global spending. This segment is especially interested in enriched and organic foods, for example, along with supporting fair trade and reducing dairy intake (Exhibit 2).

Ice cream grows as consumers splurge and focus more on health

The US ice cream market grew roughly in line with the economy over the past five years at about 2 percent annually—but fortunes have shifted. The overall revenues of value brands declined by about 5 percent each year, compared with growth of 8 percent in the middle tier and 3 percent in the premium tier. The super-premium category grew by about 13 percent annually, raising its market share from 8 to 12 percent.1 Premium and super premium now account for about 90 percent of all ice cream sold by the pint in the US market according to Nielsen’s “eXtended All Outlets Combined” metrics.

Many consumers in the United States say they have moved to super-premium brands for health-related reasons, such as the low-carb or low-fat ingredients often contained in such brands. Abroad, consumers also increasingly consider the health of the planet when selecting brands. Responding to this growing preference, Unilever announced in February 2022 that in the United Kingdom it would switch from plastic packaging for its Carte D’Or ice cream to “responsibly sourced, recyclable paper tubs and lids” to save more than 900 tons of plastic every year.2

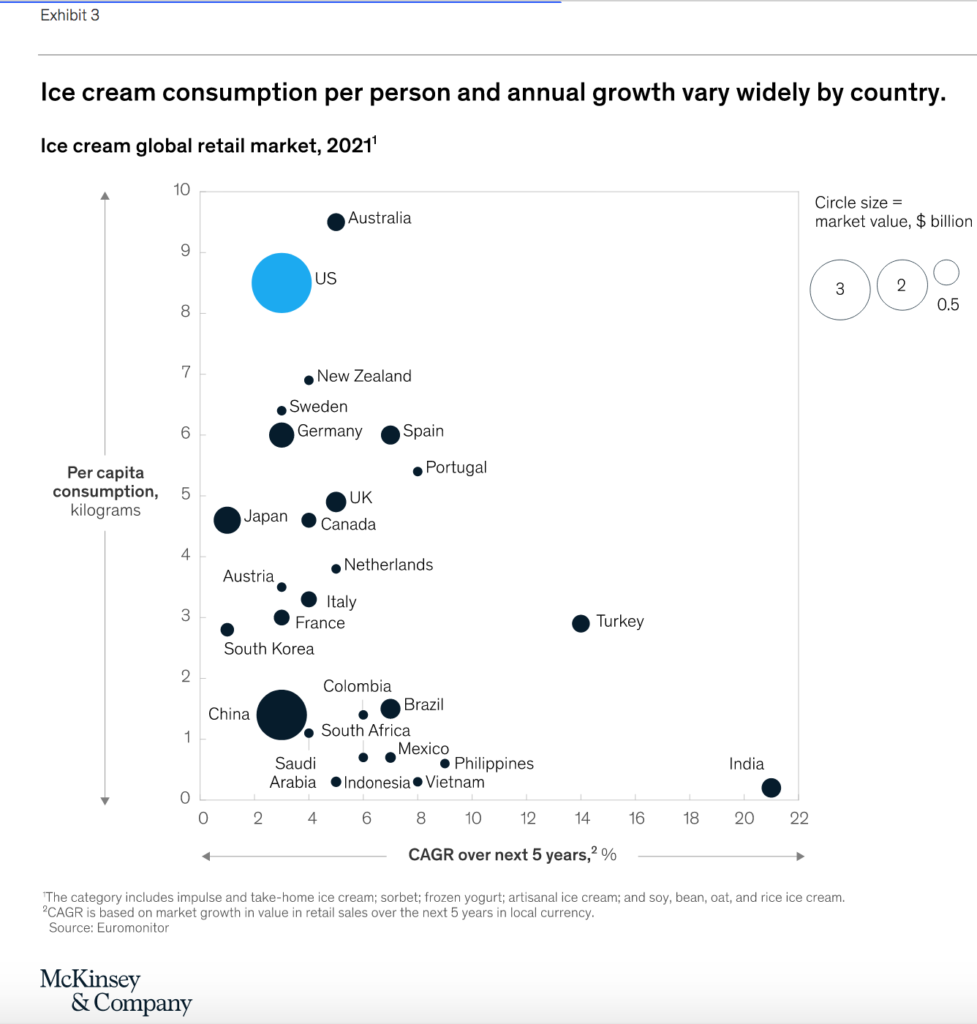

International ice cream markets vary widely. Consumption is growing at more than 20 percent annually in India, but millions of people in India who enjoy eating ice cream do not have refrigerators, presenting challenges in marketing and distribution. An average consumer in China consumes only about a third as much as a US consumer, but ice cream revenues in China are almost as large as those in the United States (Exhibit 3).

Powerful trends show growth opportunities in yogurt around the world

In the United States, sales of Greek-style and traditional dairy yogurt haven’t budged in five years, with overall per capita consumption growing at under 1 percent (Exhibit 4). During the pandemic, however, some small categories grew, including Icelandic styles, up 5 percent, nondairy, up 26 percent, and shakes, whose sales more than quadrupled from a small base to about $14 million.

Overseas, yogurt sales are growing exceptionally fast in many countries with year-round warm weather and those where many people can afford treats for the first time. Indeed, we expect a billion people to enter the global consuming class by 2025—and that most of them will crave yogurt and ice cream.

How industry leaders are innovating to drive growth and gain share

Fashions change. Shoppers used to care more about brand names, for example, and look for low-fat, fat-free, or low-calorie ice cream and yogurt. Today, they worry more about sugar than fat, are far more willing to switch brands, and want to support ethical companies. “Healthy indulgence,” especially in ice cream and yogurts, is becoming increasingly popular.

Most of all, shoppers look for flavor: nearly three out of four consumers globally consider it the most important factor in an ice cream purchase; and more than a quarter of US consumers say a new flavor inspires them to try a yogurt or yogurt drink. In the United Kingdom, about a third of shoppers said they would pay more for an innovative yogurt flavor.

Recent entries in the flavor race include Fluffernutter ice cream from Barry Callebaut and Honey Bun from Hudsonville Ice Cream. Big Spoon Creamery in Birmingham, Alabama, serves Goat Cheese Strawberry Hibiscus ice cream, in season, and Buttered Cornbread, a buttermilk ice cream mixed with corn cookies. LALA may introduce a new licuado, a type of smoothie popular in Latin America, in a mango-carrot flavor, and DFA Dairy Brands is contemplating Blackberry Pretzel Cheesecake ice cream.3 Even private labels are getting into the act, launching more than a 400 new ice cream flavors in North America in the past four years. Common manufacturing platforms—plants that manufacture both branded and private-label ice creams—allow for more agile private-label competition than in other food categories.

Many producers are creating “limited editions” to test the appeal of novel flavors. About 7 percent of yogurt launches in North America fit this description in 2021, up from just 2 percent the year before.

Product launches with ethical claims are growing even faster. The share of charity-related launches declined slightly to 6 percent in 2021, but the share of environmentally friendly product launches jumped ten points to 16 percent and human-related ethical claims to 10 percent, up from just 1 to 2 percent in the three preceding years. For example, So Delicious Dairy Free, which makes plant-based frozen novelties and alternatives to yogurt, launched a program in 2021 to help coconut farmers adopt more sustainable practices to increase crop yields by 50 percent and double their incomes.4 Redwood Hill, meanwhile, promises that it treats its goats humanely.

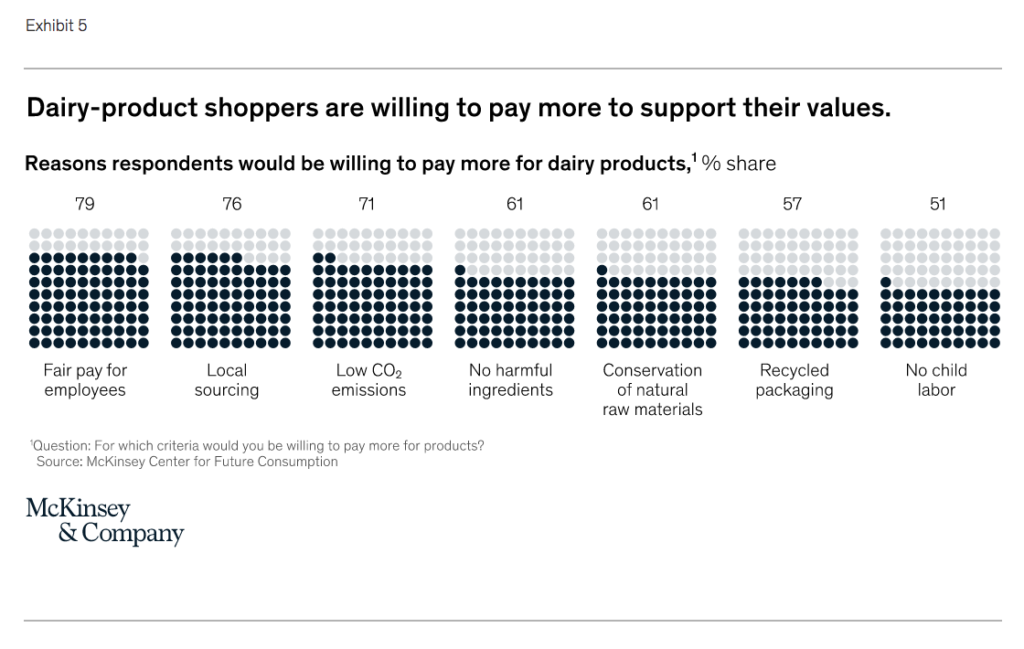

Consumers find value in many of these claims. More than seven in ten are willing to pay more for products from producers who pay workers fairly, operate locally, and emit less carbon (Exhibit 5).

Environmental, health, and animal welfare concerns come together in shoppers’ growing interest in dairy-free and plant-based yogurt and ice cream. Global dairy-free yogurt sales topped $1.4 billion in 2021, nearly double the total in 2017, and tripled in the United States to $420 million.

How the outperformers will drive innovation

Ice cream and yogurt companies will face rising challenges in the years ahead, including keeping up with consumers’ ever-changing preferences; stubborn inflation that affects raw materials, fuel, and labor costs; competitive pressure from private labels and creative, fast-moving new entrants; and kinks in supply chains.

We expect that a few companies will outperform the overall industry by wide margins, mainly by gaining a deeper and more up-to-date understanding of consumers’ needs, desires, and concerns, market by market.

As outperformers harness their superior knowledge to refine market segmentations and identify new opportunities for profitable growth, they will innovate faster on an increasingly broad array of product attributes. We expect flavor to remain the top priority for most consumers, but ingredients, packaging, distribution, and ethical promises will likely become increasingly important to millions of shoppers—even as grocery-aisle selections become ever more bewildering.

SOURCE : Mckinsey & Co article May 13th 2022 written by

By Christina Adams, Anne Grimmelt, Ludovic Meilhac and Chirag Pandya