There was a period two weeks ago during which milk prices looked promising heading through the month of October. However, the rally stopped abruptly with underlying cash prices turning lower. Cheese prices fell back, and butter peaked. Dry whey price moved higher, but the focus of traders was on cheese prices. Nonfat dry milk also trended higher but seems to possibly have reached a plateau.

Time is running out for a historical seasonal price increase as usually price will peak in September or October. There have been a few years during which prices reached their seasonal peak in November, but generally heavy buying for the holidays has run its course with usual demand carrying through with fill in buying to fill orders taking place. The inability of cheese prices to trend higher during this time of year does not bode well for the rest of the year or early next year when demand generally slows and inventory increases.

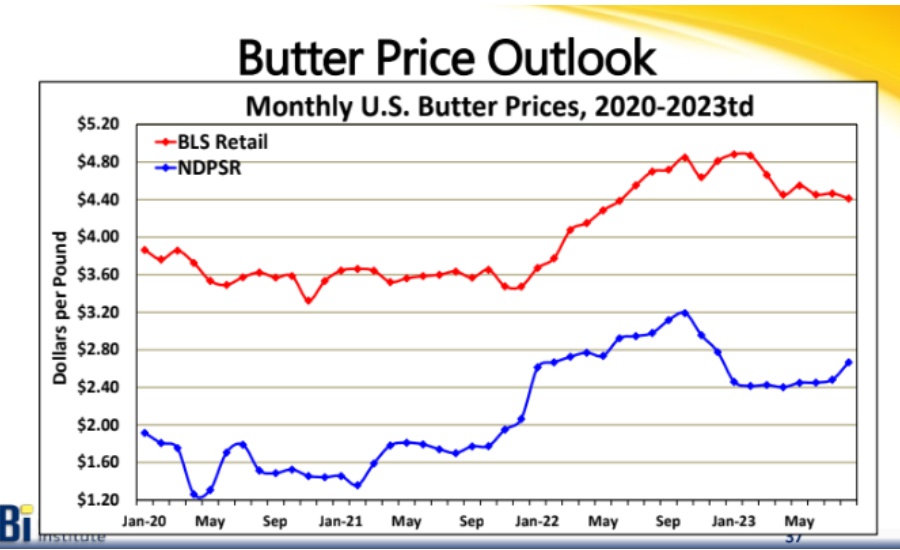

Butter price remained higher than expected and even though price has weakened, and the peak has been reached, Class IV milk prices will be good for October and November. The October price is $21.60 compared to the Class III price of $16.85. These prices will not change much as the October class prices are announced on Wednesday, November 1st. Butter may have peaked but price may chop around for a period as the calendar moves closer to the holiday season.

Graph Courtesy Dairy Foods Magazine

One reason cheese prices are not seeing much upside potential is that supply is sufficient with the September Cold Storage report showing American cheese inventory one percent above a year ago. The decrease in inventory from August was light with only 2.3 million pounds being removed. There needed to be much more removed to support the market. Buyers of cheese are not concerned over supply with sellers offering cheese on the daily spot market to keep from building inventory at the plant level. If buyers are not concerned now, they certainly will not be concerned once holiday demand is filled.

One thing that has been a surprise has been the lack of consistent heavy culling even though milk prices have been low this summer are certainly lower than desired since then. Cow numbers are lower. The nation’s dairy herd totaled 9.37 million head in September, down 36,000 head from September 2022. Even though this was the lowest national dairy herd since January 2022, milk production per cow was 4 pounds higher with milk production down only 0.2%.

The September Livestock Slaughter report showed dairy cattle slaughter substantially lower than August with 240,500 dairy cattle slaughtered, 34,700 head less than what was slaughtered in August. This was 20,000 head less than September of 2022. Farmers may have culled most of their low producing cows and are holding on to good producers despite high cull cow prices. Some cattle from farms that have exited the dairy business have been absorbed by other dairy operations leaving less cows being slaughtered. Culling has not been as aggressive as it was in late 2021 which led to the concern of tight milk supply. That is not the case at the present time as the milk supply is sufficient for processing needs.

Source : DAiry Herd Oct 30th 2023 By Robin Schmahl