How much is a pint of milk? It’s a question that has long been used by journalists to test whether politicians have any sense of the budgetary constraints of the people they govern. If you know the price of milk then you have had to think, at some point, about whether you can afford it. In 2012, David Cameron and George Osborne were described by Nadine Dorries (then a publicity-hungry backbencher) as “two posh boys who don’t know the price of milk”; Cameron later began carrying a crib sheet of prices in an attempt to appear in touch. In a 2013 interview Boris Johnson flunked the milk question (“I can tell you the price of a bottle of Champagne,” he later retorted) and Rishi Sunak struggled with the same question in 2021.

The milk question is becoming harder to answer because prices are changing very rapidly. This morning’s new inflation figures show that the cost of the goods and services in the consumer price index (CPI) are still growing at a very high rate of 10.1 per cent, but still more worrying is that food price inflation is at its highest level for more than 45 years, with prices rising by 19.2 per cent in a year.

Milk is one of the fastest-growing prices in the inflation basket: milk price inflation was 38.4 per cent in the year to the end of March. Prices hit 95p a pint before the “spring flush” – higher milk supply generated from cows newly released into pasture – prompted supermarkets to make a 5p price cut last week.

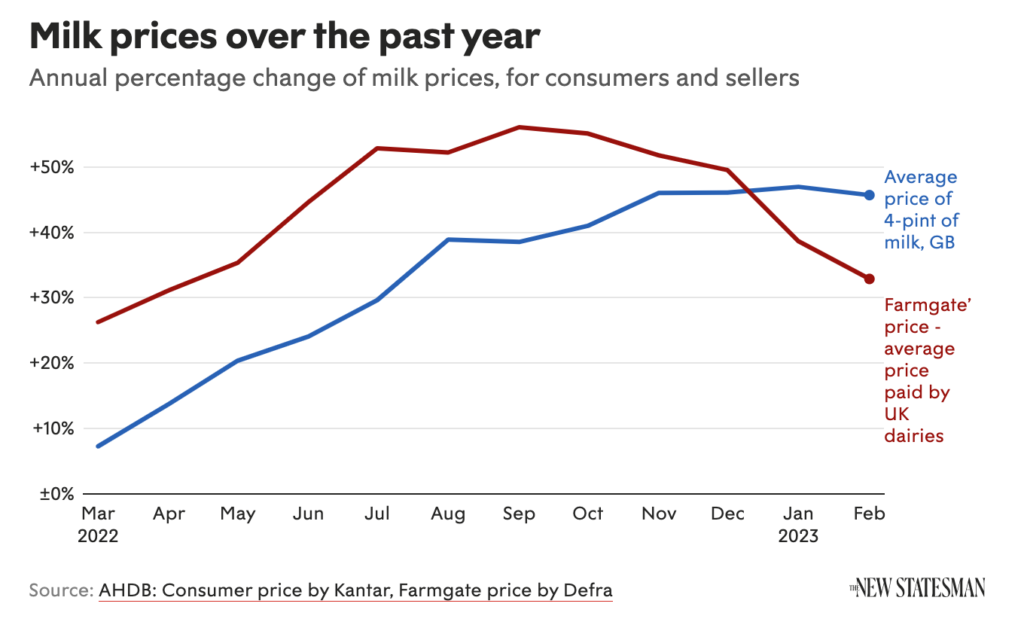

There’s a clearly intelligible story about why milk prices have risen: inflationary pressures have emerged from multiple sources. Labour is more expensive and input costs are higher – the cost of ammonium nitrate fertiliser more than doubled from August 2021 to August 2022, although it has now fallen back below pre-Ukraine war levels. Plot a graph of factory-gate milk prices against retail prices and you get what looks like a straightforward narrative: a hump in the prices charged by suppliers, followed by a hump in the prices charged in shops.

However, plot a graph of the price difference between the factory gate and your fridge, and a different story emerges. The mark-up on milk remains fairly static and then rises precipitously, as retailers make the most of the fact that consumers expect – and for the moment, tolerate – rising prices.

Paul Donovan, chief economist at UBS Global Wealth Management, says this is causing a third wave of inflation: first came the massive increase in demand for durable goods after the lockdown periods, as people spent their pandemic savings; next came the dramatic spike in energy costs caused by the war in Ukraine; and now, with those events present in consumers’ minds, businesses across the economy have a “convincing story” to tell about why prices must rise.

“With the milk price,” Donovan told me, “you have a genuine cost increase – the farm-gate milk price has risen – but the point about profit-led inflation is that you pass on a genuine cost increase, and then you expand your margin on top of it. And that’s what does appear to have been happening.”

This may not always be evident in the profits of large companies, which can use a period of profit-driven inflation to absorb other costs. Nor is it solely the work of giant supermarkets. “Large companies are involved in this,” says Donovan, “but the small corner-shops are also ramping up prices, because they can get away with it… the grandmother in the back kitchen is just as capable of price-gouging as a large company.”

Some of the narrative used to justify price rises is flatly untrue, says Donovan, such as the idea that wage rises are contributing to inflation: “No one’s facing real higher labour costs. Real wages have been catastrophically negative for two years.”

Such narratives can only last for so long, however. “A period of profit-led inflation works when consumer demand is stable,” says Donovan. “You can trade on the loyalty of your customers for a while, as long as you can convince your customers that you’re really raising prices for reasons beyond your control.”

One way in which the government could intervene would be to address the facts about the drivers of inflation more frankly. This is happening in other countries, such as the US and Sweden, where competition regulators are investigating companies’ use of their market power to inflict “greedflation” on the economy. But George Dibb, head of the Centre for Economic Justice at the Institute for Public Policy Research (IPPR) think tank, says that while the UK’s competition regulator is investigating price-gouging by petrol stations, “we haven’t had the same focus on corporate profits in this country compared to the US or the EU. The attention is much more on wages than profits, even though the data would indicate that wages are not driving inflation right now.”

Dibb says that in practice the “first line of defence” against greedflation has to be the welfare system, because steep rises in the prices of basic foods such as milk are felt most seriously by people on low incomes. But the windfall taxes levied on energy companies could also provide a model, “where there is a strong evidence of windfall profits, the government can legitimately take action to recoup some of those excess profits… It is hard to argue it’s fair for supermarkets to be growing their profit margins at a time that people can’t afford food.”

Source : The Statesman April 20th 2023 by Will Dunn