How much milk does India really produce? What is its actual domestic requirement of cereals or sugar?

These are simple questions, but basic to understanding the market for agri-produce — not just in these inflationary times, but also from a policy and planning perspective.

Consider milk. According to the National Statistical Office’s (NSO) household consumer expenditure (HCE) survey for 2011-12, the monthly per capita consumption of milk was 4.33 litres in rural India and 5.42 litres in urban India. Taking an average of 5 litres (5.15 kg; 1 litre of milk = 1.03 kg), this translates into an annual consumption of nearly 75 million tonnes (mt) for a population of 1,210.85 million as per the 2011 Census.

This figure includes only milk consumed by households — directly and as curd, butter, ghee, paneer, etc. at home. It excludes milk consumed by businesses — tea shops, hotels, and ice-cream, sweetmeat, chocolate and biscuit makers. If this milk is assumed to be 25% over and above that consumed by households, it adds up to about 94 mt — or a daily per capita availability of 212 gm.

What production data show

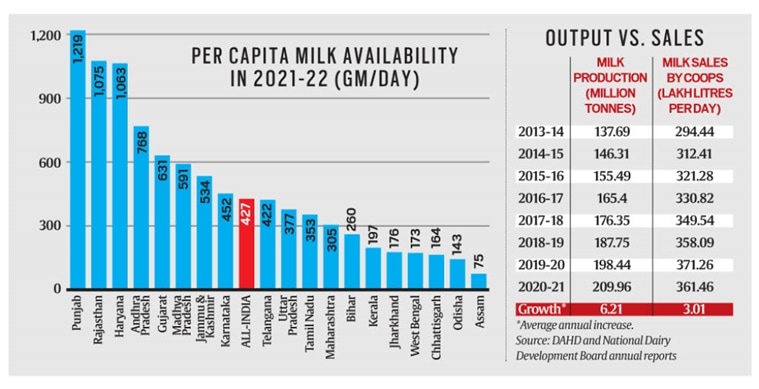

Going by Department of Animal Husbandry & Dairying (DAHD) statistics, India’s milk production in 2011-12 was 127.9 mt with a daily per capita availability of 289 gm. These were 210 mt and 427 gm respectively in 2020-21.

Unfortunately, there is no published HCE survey data after 2011-12. In all likelihood, the gap between the NSO’s consumption-based estimates and the DAHD’s production numbers would only have widened. India’s milk production in 2011-12 was 127.9 mt with a daily per capita availability of 289 gm. These were 210 mt and 427 gm respectively in 2020-21.

India’s milk production in 2011-12 was 127.9 mt with a daily per capita availability of 289 gm. These were 210 mt and 427 gm respectively in 2020-21.

Between 2013-14 and 2020-21, India’s milk production grew at an average 6.2% a year. (Table) But this isn’t reflected in the marketing of liquid milk by dairy cooperatives, which grew by just over 3% annually in volume terms during this period.

In the private sector, growth in the average sales of 12 major dairy companies averaged 4.93% in nominal terms between 2014-15 and 2020-21. After adjusting for an average wholesale price inflation of 3% for “dairy products” over this period, their real sales growth was slightly more than 1.9%.

Discrepancies are glaring

Clearly, the 6.2% growth in milk production based on official DAHD statistics does not seem to square up with the sales growth of organised dairies, averaging only 2-3% per year.

Equally interesting is the per capita daily milk availability of 427 gm for 2020-21, which, by definition, is the average for India’s population — across regions, rich and poor, babies, the young, and the aged. (Bar chart)

In Punjab, the average person supposedly consumes 1,219 gm or close to 1.2 litres per day; Rajasthan and Haryana are also more than 1 litre. The 2011-12 HCE survey, however, reported daily per capita milk consumption at 0.49 litres in rural Haryana and 0.37 litres in urban Haryana. The corresponding figures were 0.40 litres and 0.36 litres for Punjab, and 0.31 litres and 0.29 litres for Rajasthan.

Even after factoring in indirect/non-household consumption and population increase since 2011-12, the per capita average for these high milk-drinking states is unlikely to exceed 0.5-0.6 litres.

Looked at another way, if the DAHD’s 427 gm figure is correct, an average Indian family of five would be consuming more than 2 litres of milk every day, going up to 5-6 litres in Punjab, Haryana and Rajasthan.

It’s a moot point how many families can afford to spend so much on a single food item that costs Rs 40-50 per litre. On the other hand, there is a limit to how much milk the rich can consume.

One has to probably wait for the next HCE survey to obtain more reliable estimates of milk consumption in India, which can then be reconciled with the DAHD’s production data.

Demand is the key

Knowing what and how much Indians are consuming — which only a comprehensive nationwide HCE survey can reveal — is useful for analysis of demand and supply in other farm produce too. It helps in framing policies better, whether on fixation of minimum support prices and tariffs or on crop diversification.

For example, the monthly per capita household consumption of all cereals in the 2011-12 survey was assessed at 11.22 kg for rural India, and 9.28 kg for urban India. At an average of 10 kg, the annual household cereal consumption requirement for 1,400 million people today would be around 168 mt. Assuming 25% additional consumption in processed form (bread, biscuits, cakes, noodles, vermicelli, flakes, etc.), and another 25 mt of grain (mainly maize) for feed or starch, the total yearly demand would be around 235 mt.

As against this, cereal production from 2016-17 to 2020-21 has averaged 267 mt. If the Agriculture Ministry’s output estimates are accurate, the country is producing 30 mt-plus of surplus grain every year — partly borne out by overflowing rice and wheat stocks in government warehouses, at least till quite recently.

But again, one doesn’t know how accurate the official production estimates are. Nor whether per capita cereal consumption is increasing or decreasing — it was falling in the previous HCE survey rounds, while rising for milk, eggs, chicken, vegetables and fruits. And what has been the impact of the more recent free/near-free grain schemes such as the National Food Security Act and Pradhan Mantri Garib Kalyan Anna Yojana?

Discrepancies in production may be less for a commodity like sugar, where most of the cane is crushed by organised mills. Direct household consumption, at almost 1 kg per capita per month, would work out to 16.8 mt for a population of 1,400 million. Indirect consumption may be another 50%, as sugar has more bulk users — including soft drink, confectionery makers — than milk or wheat. That takes the total domestic demand to 25-26 mt, compared to an average production of 32 mt in the last five years. Sugar has been prone to overproduction, with rare exceptional years.

A larger question

There is a more immediate reason why a new HCE survey is needed. The current consumer price index — used to calculate inflation and also for RBI’s interest rate actions — is based on the consumption basket from the 2011-12 HCE survey. That basket is perhaps outdated and not truly representative of the items, both food and non-food, being consumed by Indian households today. And it may, to that extent, not be useful for either agriculture or monetary policy.

Source : The India Express 10th Oct 2022 by Harish Damodaran