Dealers, who were not claiming the input tax credit earlier, can get it reimbursed now

Chief Minister Basavaraj Bommai, who also heads the Group of Ministers (GoM) on GST rate rationalisation, announced here on Monday that he will ask traders not to pass on to consumers the 5 per cent GST levy on dairy items, packaged and branded food products.

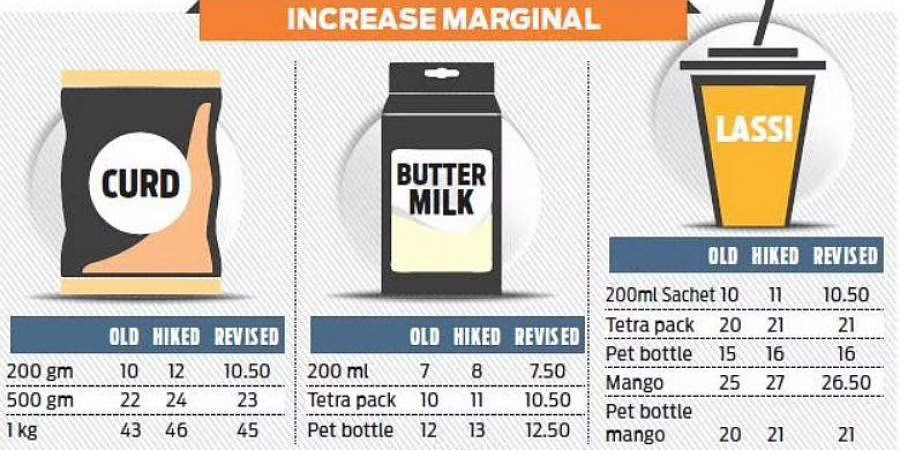

The state-run KMF responded quickly and revised the rates of its products, including buttermilk, lassi and curd, though it did not fully roll back the prices. There was no information on others following the directions.It was KMF’s decision to increase prices of its products from Monday that came as a shock to consumers, who slammed the government on social networking sites.

Bommai was forced to control the damage by advising dealers not to pass on the tax burden on to customers, when there is a provision to get it reimbursed from the government.

“The 5 per cent GST is only on the packaged and branded food items which is not meant to be passed on to consumers as traders can get the duty paid reimbursed in the coming days. I will get instructions from the GST Council in this regard,” he clarified.

Dealers, who were not claiming the input tax credit earlier, can get it reimbursed now. Rice mill owners recently shut their business in protest against the levy of 5 per cent GST on the food items.

Source : The Indian Express 19th July 2022