Consumers and brands alike were blindsided by the pandemic and subsequent lockdowns, but a few companies with operations outside India were slightly ahead of the curve.

While the list of companies able to achieve this feat is long, for a household brand, catering to a country of 1.38 billion people, it was one of the toughest strategies to crack. And all this while maintaining growth. The companies that managed to exemplify this are Gujarat Cooperative Milk Marketing Federation (GCMMF), the parent of Amul, and Parle Products.

So, how did they do it?

- Both Amul and Parle Products launched new products in new categories during FY21 and FY22.

- The companies made sure to give back to the people.

- They focussed on SKUs of different sizes.

Pushing new launches

Amul is following two strategies — launching new products both in dairy and non-dairy, and products within high-margin categories. In May 2022, the company announced its entry into the organic food market with its Amul Organic Whole Wheat Atta. Next in the radar are pulses.

Amul currently has presence across 26 packaged food categories. Parle Products, on the other hand, currently has nearly 50 brands across nine categories.

The expected CAGR for the period of 2022-2026 for staple foods (overall) is around 9%. Breakfast cereals are likely to grow at 12%. Both companies recognised the growth potential of these categories and planned their new product developments accordingly.

Amul is also focussing on high-margin categories for better revenue generations with new launches in packaged sweets and flavoured milk.

Taking care of your people

Another thing that Amul did during the pandemic was to make sure the farmers were compensated, and employees are taken care of.

While various measures were taken by the cooperative over the last two years, in FY22, GCMMF launched ‘Amul Micro ATM Project’. The project was initiated with DGV – a dairy neo-banking startup. Through this, the cooperative made sure that dairy farmers could save 2%-5% TDS.

Parle Products ensured Indians at all levels had access to biscuits.

“We spoke to the government about essential foods. However, that wasn’t enough for packaged foods, as making the product required transportation of the ingredients and packaging material. So, we spoke to the authorities to allow movement of those things as well,” says B Krishna Rao Buddha, senior category head, Parle Products.

“We were following what was happening globally with the Covid-19 before it hit India. Hence, when the first lockdown was declared, since everyone was buying in bulk, our warehouses were empty!” adds Buddha.

The company also donated 3 crore packs of biscuits worth INR20 crore – INR25 crore via government agencies to help those who were severely impacted.

“We made sure we delivered to hospitals as well. Doctors and nurses were working round the clock, often with no food. We worked with government agencies to make sure people across the board, including those who were going to their hometowns on feet due to lack of jobs in the cities, the lower economic classes, all had access to our biscuits,” says Mayank Shah, senior category head, Parle Products.

Keeping up with the changing consumer behaviour

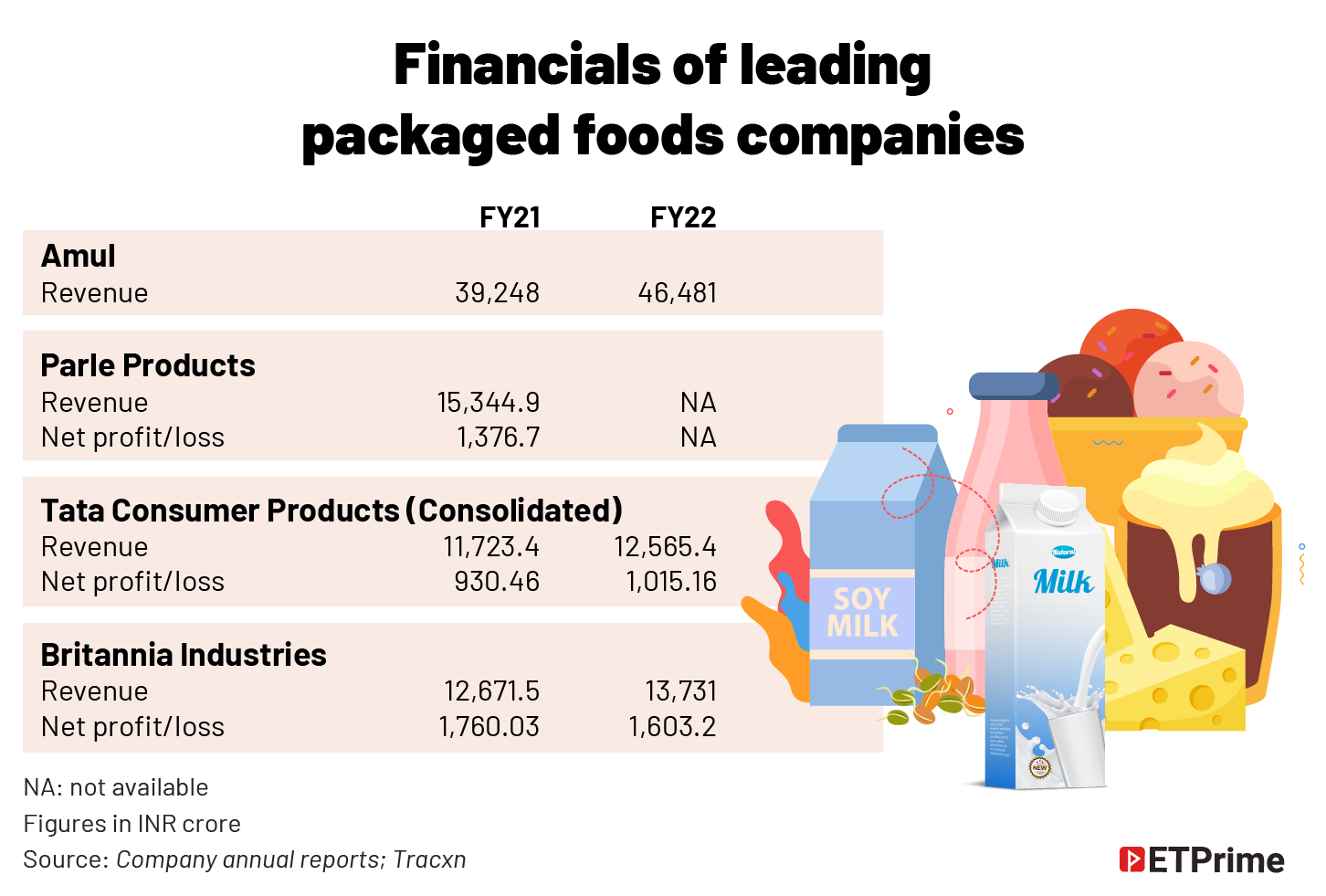

According to Euromonitor International, by CY22 the packaged foods market in India will grow to USD93.7 billion.

The leading category within packaged foods is cooking ingredients and meals — the total market for which in India was sized at USD26.5 billion as of CY21, closely followed by dairy products.

India is amongst the largest producers of milk and is self-reliant for its domestic demands. The country contributes to 21% of the total global milk production.

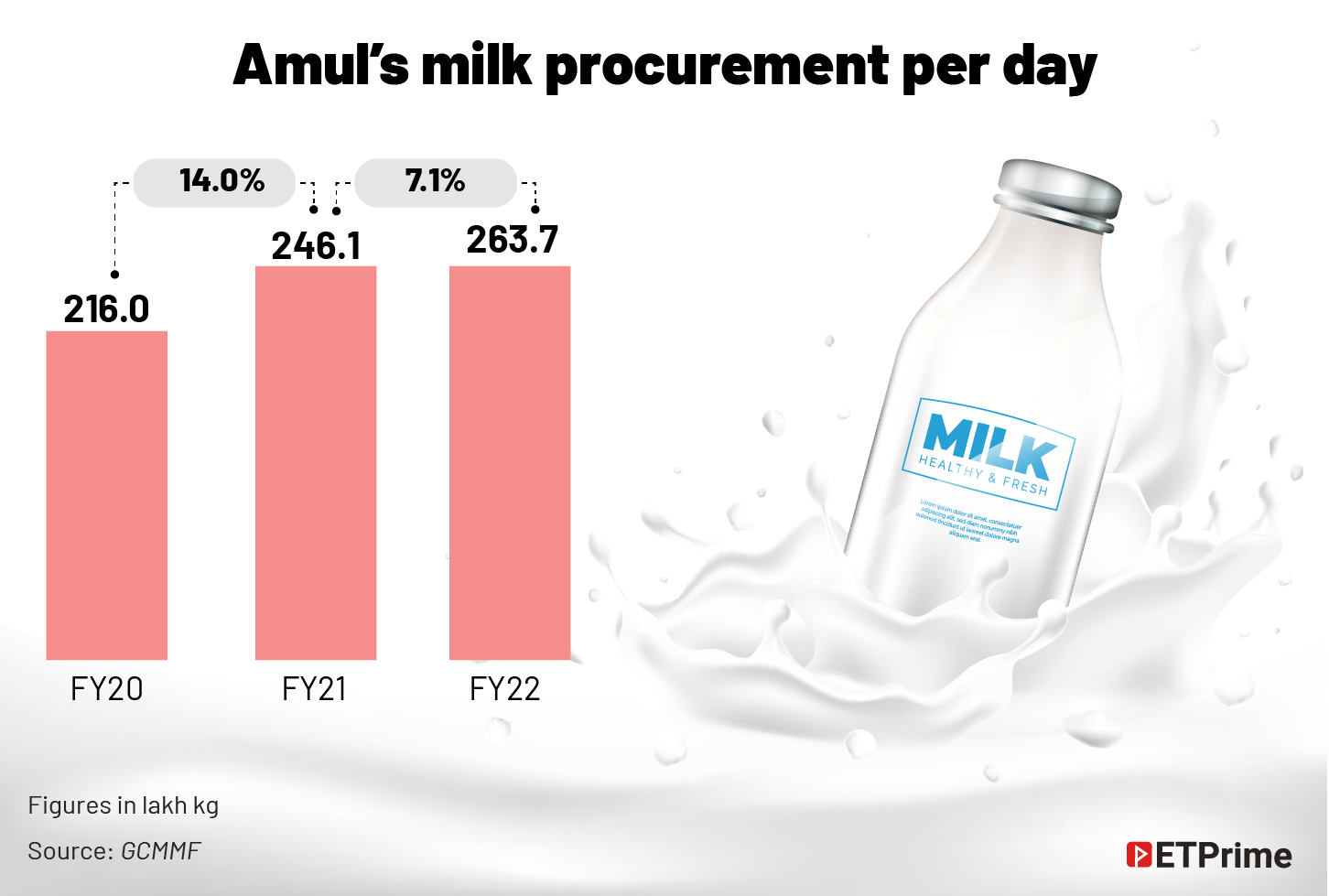

Amul has increased its milk procurement per day since 2020 and has not slowed down despite the pandemic. The company has also increased its prices over the last two years.

However, despite the price increase, RS Sodhi, managing director, Amul India, told ET Now, that the demand has not been impacted. In fact, the company has seen a jump in demand from tier II and tier III cities.

The company in 2021 launched Amul Cart App. This app allowed retailers to place their orders directly with Amul’s distributors. This was one of the most useful tools for the company, especially when the out-of-home consumption, and HORECA (Hotels, Restaurants and Canteen) sales were almost negligible.

Parle Products recognised the change in consumer behaviour in terms of the size of packets being purchased.

“Consumers were buying in bulk during the lockdown. And this is something that is continuing even now in 2022. Consumers are more likely to buy larger packs of biscuits – which can be anywhere between 250gm-300gm pack size and above,” says Shah.

He confirms that Parle Products has been focussing on increasing larger pack size SKUs for its biscuits.

What next?

As we enter Q3 with the impact of the pandemic receding, and businesses going back to usual, there is one particular change in consumer behaviour, which started during the pandemic and is here to stay – preference for branded and packaged foods over unbranded options.

Consumers across all income levels are trying to move to packaged foods for their needs including staples, and cooking ingredients such as edible oils. The packaged foods category (overall) is expected to grow at a CAGR of 9% during 2022-2026.

As of 2022, both Amul and Parle Products have presence across 7.2 million retail touchpoints.

“In the last decade or so, for most of the large FMCG brands, 7%-10% of the revenue came from modern trade, and the rest from kiranas. E-commerce used to be 1.5% of the overall sales. But now, in a post-pandemic world, for Parle Products while modern trade continues to be the same, online channel sales has increased to 5.5% as of FY22,” says Buddha of Parle Products.

“The pandemic has established the infrastructure needed for quick commerce. If you want to order ice cream at 1:00 am, there are retail partners who will deliver. E-commerce and quick commerce will drive packaged foods sales in this post-pandemic world,” he concludes.

(Source : The economic Times :Originally published on Oct 15, 2022, by Shabori Das)