Dairy is a ubiquitous part of food sector, ever present in both food service and packaged goods, whether as an end product (such as milk or yogurt) or as a critical input for iconic products such as cheese.

Given its intrinsic presence, dairy is a microcosm of the food industry, with the preferences of dairy consumers largely being influenced by the same trends affecting the broader food sector.

The past year has challenged the dairy products market in several ways, including the rapid switch in demand from food service to retail. But the industry has proven its resilience and ability to meet consumer needs. Nonetheless, to succeed in the next three to five years, dairy executives must revisit their approaches to critical, evolving trends in consumer behaviour, digital and analytics, and supply-chain management.

One key trend that will reshape this industry is the Direct to Consumer (D2C) model with more and more dairy manufacturers taking the initiative to offer their products directly to end consumers. Consumer behaviour shaped by digital and social media has strongly promoted the development of D2C Go-to-market model which has been further accelerated by the pandemic.

In this article we will analyse the benefits of the D2C strategy for milk and milk products in the dairy industry. Compared to traditional retail, which relies on distributors and wholesalers, the D2C model takes out the middleman, allowing manufacturers more control over their brands.

The global dairy products market is expected to expand at a compound annual growth rate (CAGR) of 2.5% until 2027. As per a report on Dairy Products Packaging by Future Market Insights, the massive consumer base in countries such as China and India for consumption of milk and milk products is a key market driver.

Europe accounts for the largest revenue share in the market for dairy products of around 32%. The rising consumption of dairy products and shifting consumer preference from meat to dairy products for protein enrichment are the significant drivers for this market’s growth.

In order to meet such significantly rising consumption of dairy products, the manufacturers are now looking at D2C sales channel as a new and more profitable trend to sustain growth in the competitive industry over coming years.

Setting up a Direct-to consumers Model

The digital and e-commerce revolution has drastically changed how dairy brands are reaching their customers. Instead of using wholesalers or retailers, direct-to-consumer model helps sell dairy products directly to the end customer.

The resulting shift in power has been devastating for traditional retailers, and yet simultaneously, some of the most innovative and successful dairy companies of the last decade have been born from this movement. Namely, Country Delight delivers fresh, unadulterated dairy and food products directly to the doorstep of the consumer. It launched with selling milk and has since expanded to other dairy products, such as curd, eggs, ghee, bread etc, and even staples. Other companies like Amul and Nestle’ are using e-commerce to deliver products directly to consumer.

The traditional supply chain includes a supplier, manufacturer, wholesaler, distributor, and retailer. The retail sales model often involves lengthy negotiations at each stage of production or delivery, and it typically results in a long lead time for product launches and an even longer wait for the customer feedback loop to kick in.

Direct- to- consumers model ignores that traditional standard. Companies can cut out the middleman, the wholesalers, and the distributors and instead harness the power of social media and the rise of e-commerce to sell their products directly to end consumers.

Direct-to-consumer sales model eliminates the barrier between producer and consumer, giving the producer greater control over its brand, reputation, marketing, and sales tactics. Plus, it helps the producer directly engage and therefore learn from their customers. This model can be implemented in different ways by manufacturers. Online marketplaces and platforms such as Amazon and eBay offer product listings and direct sales to end customers.

Alternatively, manufacturers can operate their own online shop or use social media platforms to offer products in the context of Social Commerce. Numerous start-ups pursue a pure direct-to-consumer approach and demonstrate considerable growth, making them attractive acquisition targets.

Why Dairy Manufacturers are Opting for the Direct-to-consumers Marketing Strategy?

The Dairy products industry has witnessed a significant growth over the past decade. With growing consumer preference and rising demand for dairy products, the market is expected to grow further over coming years.

Shipping dairy products imposes major challenges mainly due to the perishable nature of most of the dairy products. Managing the shipping involves managing the inventory, distribution network and supply. Each of the steps require proper storge of the dairy products.

During the pandemic the supply chain of dairy products was hindered causing major losses to the manufacturers. Hence for better supply management and in order to gain higher profit margins and brand loyalty, dairy product manufacturers are opting for direct-to-consumers marketing strategy.

Direct-to- Consumers Model proving most efficient for Milk Products and Tetra Milk Marketing

Although dairy products are highly perishable in nature a lot of efforts and research has been put into increasing the shelf life of these dairy products.

A number of thermal and non-thermal processing technologies are incorporated to increase the shelf life of milk and milk products. These techniques help the dairy products to last longer under ambient storage conditions.

Hence milk and milk products manufacturing companies have come up with their new range of tetra pack milk and other milk products with an increased shelf life. But even these products require ambient storage conditions throughout the supply chain process.

Most of these manufacturers are now using direct-to- consumers GTM model for marketing their products. This provides them direct access to the consumers; manufacturers achieve higher margins by eliminating the middlemen from the picture.

A middleman selling their products means they only make profit on the markup from cost to gross sale. Direct-to- consumers model allow manufacturers to sell products at the same price as retailers, positively impacting their profits.

Milk products and milk tetra pack manufacturers are no longer restricted by geography when selling direct -to- consumers. They can go global by just selling to the right customer segments, in the right market. Adopting a direct-to-consumer strategy is beneficial from a financial as well as operational standpoint.

One of the biggest challenges that dairy businesses face under a traditional retail model is gaining access to the markets where they want to sell their products. In many cases, large regional retailers won’t agree to carry a product unless it already has a lengthy history of proven sales.

And when they do agree to carry a product, many insist on exclusivity agreements that limit where else the items may be sold. In a direct-to-consumers model, businesses can bypass these gatekeepers and offer their products straight to consumers.

Although currently the retail distribution channel accounts for around 60% of the dairy products market share, many dairy companies are now adopting the direct-to- consumer sales channel for better customer service and increased market reach.

Some of the prominent dairy products manufacturing companies delivering products directly to consumers are: Oppo, McQueens Dairies, DairyDrop, Butlers Letterbox Cheeses, Pong cheese, Eweleaze Dairy Organic, Ben & Jerrys, The Modern Milkman and Amul.

How are Retailers Competing with the Direct-to- consumer Model?

With more and more companies adapting the direct-to-consumers model, the businesses of traditional retailers have been adversely affected. However, progressive retailers, who wish to remain relevant, have adapted their business model to cater to non-linear buyers. The multi-channel, or omni-channel, shopping experience they offer includes:

- Website

- Mobile app

- Presence on social media

- Presence on price comparison sites

- E-payment gateways

How are brands benefiting from Direct-to consumers Model?

The direct-to consumer model proves to have many advantages over the traditional retail sales model.

- Cost Savings: Moving to a direct-to-consumers GTM model is a smart strategy for decreasing overhead costs. Manufacturers following this model have a lot more flexibility in terms of operational costs and logistics, pricing structures and other considerations

- Brand Resonance: Many leading brands have made names for themselves by offering everyday products that are more affordable, more sustainable or simply more exciting than those found in traditional retail settings

- Increased Personalization: The direct-to-consumers GTM model offers better consumer relationship and consumer feedback data

What are the Challenges Faced by Dairy Companies While Adapting the Direct-to-consumers Model?

The dairy industry is facing major challenge as consumer preference is leaning more towards plant-based milk, meat alternatives, and vegan offerings. Hence, manufacturers are trying to enhance the nutritional profile of dairy products by adding health-enhancing ingredients. They have to find and use ingredients that can offer functionality and shelf life in the most minimalist way possible.

Other challenges faced by the dairy manufacturers include:

- Marketing and Pricing: Direct-to-consumer model involves managing production as well as entire supply chain by the manufacturer which is not only expensive but also requires huge man power and robust technical support. This adds to the overall cost making the products more expensive compared to the retail counterparts. Also, marketing, advertising and customer acquisition cost further make the products costlier.

- High Cost of Handling and Distribution: In a direct-to-consumers model, manufacturers can avoid having to deal with a lot of external

Intermediaries. But this in turn means they must adapt to manage many internal processes. These include orders and shipments, agreements with transport agencies, online payments, returns and exchanges, and 24/7 customer support, not to mention each of their associated costs.

To manage all this, manufacturers will have to invest in good resources and logistical experience so that they can measure up to the level of service offered by retailers to their customers.

Future in Dairy Industry: D2R & D2C business models

The milk industry is an extensive network of farmers, dairy cooperatives, and private players. To increase profitability levels and safeguard the industry’s future, Direct to Retail (D2R) and D2C (Direct to Consumer) or DTH (Direct to Home) business models are now gaining momentum. The largest dairy companies in the world like Dairy Farmers of America, Fonterra, Nestlé, Amul (GCMMF), and Danone all actively adopt these models.

Direct to Retail (D2R): Under the D2R dairy model pioneered by Amul, middlemen are effectively eliminated, as companies/brands procure milk directly from farmers, pay them commensurately, process the milk, and sell to end consumers through company-owned milk parlor chains and retail stores. Examples of prominent D2R players are the dairy co-operatives and milk federations of respective states (like Mother Dairy in West Bengal, Aaarey in Maharashtra, Aavin in Tamil Nadu, Nandini in Karnataka, etc.) and private players like Heritage Foods, Creamline Dairy Products, and Schreiber Dynamix Dairy.

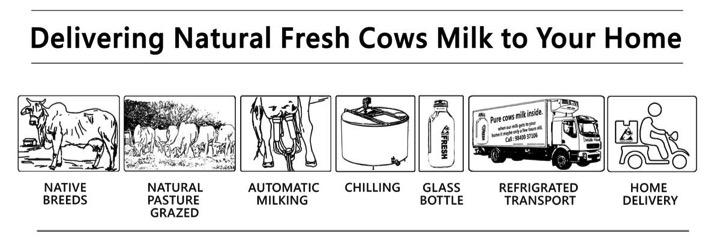

Direct to Consumer (D2C): With the rise of ‘milktech’ start-ups, this model has gained popularity during the recent COVID-19 pandemic, as consumers have shunned physical stores and favoured direct door-delivered purchases. Prominent examples of this model include Kiaro – a Hyderabad-based app-driven organic dairy products brand, Parag Milk Foods’ ‘Pride of Cows’ in Mumbai and Pune and Milk Mantra’s Milky Moo in Bhubaneswar and Cuttack.

Disrupting the industry in recent times, new-age start-ups have changed the game. Attracting global investors, they have redefined the market by offering customized tech-focused services, with flexible options of pre-payment and long-term subscriptions.

The future of the dairy industry is D2R and D2C. In these business models, product quality is standardized and maintained in conformity with international standards and certifications, and the network farmers get a better price. With regard to the milk industry, these private players use state-of-the-art infrastructure, world-class farming practices, advanced technology, and packaging techniques.

How will the Dairy Direct-to- consumers GTM Model evolve in the Future?

The direct-to-consumers model mainly relies on e-commerce and with the continuation of e-commerce revolution that’s been underway for the past 25 years, this trend is expected to maintain traction over coming years.

Since a direct-to-consumers GTM model means cutting retail partners out of the process, it also means a business won’t have to invest the time it takes to grow their presence in one regional market at a time. With a digital selling platform, direct-to-consumers dairy businesses are everywhere at once; accessible to anyone with an internet connection.

That makes adding new products to their line-up simple and their reach immediate. They also don’t have to worry about maintaining relationships with countless competing retailers, and don’t have to worry about one partner cutting into the sales of another.

Currently many dairy product manufacturers are exploring the direct-to- consumers GTM model, this number will continue to increase as more and more dairy manufacturers become aware of the benefits of this model.

Over coming years, the direct-to- consumers GTM model is expected to become more structured with many new dairy product manufacturers opting for direct-to- consumer’s sales channel via e-commerce.

This way the dairy businesses will gain complete and direct control of their brand and its image. The direct-to- consumers model will help the dairy manufacturers embrace a robust e-commerce architecture by letting them select an experienced partner for warehousing and distribution needs.

Many dairy product manufacturers are investing on company websites and mobile applications which will help them have better control over order deliveries and establish a better personalized customer experience.

Hence technology and e-commerce are expected to play important role in shaping the future of direct-to- consumers GTM model in the dairy industry.

Source : Dairy Business 13th jan 2022 written by : Nandini is an experienced Research professional and client research partner at ESOMAR-certified market research and consulting firm Future Market Insights (FMI). FMI is headquartered in Dubai, with offices in the US, UK, and India.