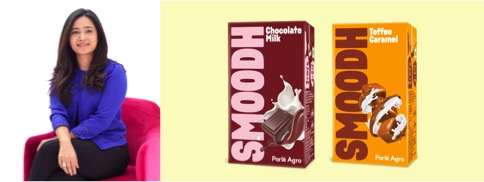

Twenty years after its brief flirtation with dairy products, Parle Agro Pvt. Ltd is back in the market with Smoodh flavoured milk, throwing a challenge to rivals such as Amul, Nestle and ITC which have carved up India’s value-added dairy beverages market.

The Mumbai-based maker of Frooti and Appy fruit drinks soft-launched Smoodh at ₹10 per 85ml pack last month. According to Nadia Chauhan, joint managing director and chief marketing officer, the product has received equal demand from both urban and rural markets, and the company plans to distribute it to over 2 million outlets across India.

“When we look at dairy, the biggest challenge that we saw was that while there is a huge market that exists for dairy, as you know flavoured milk or even other value-added dairy products, the price point is a barrier. In the flavoured milk category, almost all 200ml milk products are priced at ₹20, ₹25 or ₹30,” Chauhan said in an interview.

Competitive landscape of Flavored market

ITC’s Sunfeast and Hershey chocolate milk shake are both priced at ₹35 for 180ml, while Amul Kool comes for ₹20. According to Chauhan, India’s flavoured milk market is at a nascent stage and high prices are keeping many consumers away.

Parle Agro, whose brand turnover for FY2020 is ₹7,000 cr, has invested ₹100 crore to manufacture Smoodh at its plants at Mysuru and Sitarganj (Uttarakhand), and plans to add two more locations before the end of the year. It has also earmarked ₹30-40 crore for initial advertising and marketing, before launching the product countrywide.

Chahuan said Parle Agro will focus on the mass market, entry-level price point to attract more consumers. “Our entry into the dairy market was dependent on us being able to crack that price point. So, it’s been years of research and development that’s gone into just being able to arrive at this ₹10 price point,” she said.

Parle Agro launched N-Joi fruit milk in 2001, only to wind up the product four years later.

Food inflation

The Smoodh launch comes at a time when rising inflation is pushing food and beverage companies to launch lower grammage packs or raise prices. Parle Agro has held on to prices for its ₹10 Frooti pack, for instance, for well over 15 years.

“Our entire approach towards being able to sustain at this price point (across products) is based on creating very high levels of efficiency across the entire operation—whether it’s from the production to the final point of sale, the efficiency that we create within this SKU, and drive profits through volume,” she said.

India’s branded flavoured milk market is estimated at ₹800 crore and Parle Agro expects to grow that to ₹5,000 crore in the next four years, Chauhan said.

ITC’s Sunfeast brand, The Hershey Company, Amul, CavinKare and Nestle India, besides several large and regional companies currently sell packaged flavoured milk. “Over the course of the next five years or so, we should be able to grow the category multi-fold — three to four times its current size. We are looking to create a substantial dent not just in the beverage category, but in the ₹10 chocolate category as well which is currently an ₹4,300 crore industry,” she said.

Source : Mint ,July, 14 2021 by Suneera Tandon